URD 2024

-

2.1Activity during the year

▰2.1.1Highlights

The highlights mentioned below are a selection of the events and transactions that took place during the year for the Group and each of the strategies.

Corporate

- ▰Eurazeo completed strategic recruitments within its Investor Relations team, led by Mathieu Teisseire, Managing Partner and member of the Eurazeo Management Committee:

- •Katrin Boström, Managing Director, is responsible for the Nordics and the UK within the Investor Relations team. She will be in charge of developing Eurazeo’s client franchise and fundraising in these strategic geographic areas. This appointment reflects the Group’s ambition to create the leading private asset manager in Europe in the mid-market, growth and impact segments,

- •Adrien Pinelli, Managing Director, is responsible for the Middle East within the Investor Relations team. With 20 years of experience as a diplomat, particularly in Gulf countries, Adrien Pinelli is in charge of developing fundraising and investor coverage in the Middle East. He is also in charge of the Group’s International Public Affairs,

- •Ken Hu, Director, joined the Eurazeo teams during the opening of the Tokyo office in Japan. This office reflects Group’s willingness to get closer to its clients and support its portfolio companies in this region. Ken Hu will be responsible for business development and investor relations in Japan;

- ▰In 2024, Eurazeo furthered its continuous improvement in sustainability and impact. These commitments were once again recognized by the main non-financial rating agencies: maximum rating of 5 stars in the 5 PRI (Principles for Responsible Investment) appraisal categories; AA rating by MSCI (Morgan Stanley Capital International) ESG (Environment, Social and Governance) confirming its status as a “Leader”; Low Risk category by Sustainalytics, indicating a low financial risk.

Private equity

Buyout

Mid-large

In 2024, the Mid-large activity was marked by two divestments and one acquisition, confirming the success of the strategy supporting first-rate high growth potential assets.

- ▰finalization of the sale of DORC (Dutch Ophthalmic Research Center) to Carl Zeiss Meditec AG, one of the leading medical technology firms in the world. This investment reflects Eurazeo’s strategy to support midcaps that are “leaders” in buoyant sectors. The deal generated a gross return of 2.6x the initial investment and an internal rate of return of 24%, with around €386 million in gross divestment proceeds for Eurazeo;

- ▰exclusive discussions with a consortium led by La financière de Blacailloux for the sale of Albingia, a company specializing in the French commercial insurance lines market and the only independent player in its market in France. The consortium also includes Krefeld and Fairfax Financial Holdings. Following these discussions, Eurazeo would sell its entire financial stake of 70% in Albingia, for a return – including dividends – of 2.2x cash-on-cash. The transaction is expected to bring approximately €289 million of sale revenues to Eurazeo’s balance sheet. The transaction, which remains subject to the approval of the relevant authorities, is expected to be finalized in spring 2025;

- ▰Eurazeo and its co-investors finalized the acquisition of Eres Group for over €350 million, after obtaining all necessary regulatory and competitive approvals. This investment represents the fifth transaction for the EC V fund, which is now more than 40% deployed.

Small-mid

The Small-mid activity in 2024 was marked by numerous divestments and investments. Its flagship program, Eurazeo PME IV, was therefore 72% deployed with NAV growth of 36% during the year.

- ▰sale of Efeso to Towerbrook Capital Partners. This sale generated a multiple of 3.0x for the Eurazeo PME III fund. Convinced of the company’s growth potential, Eurazeo, via its Eurazeo PME IV fund, reinvested alongside management and the new shareholders as part of a co-control framework with TowerBrook Capital Partners;

- ▰sale of Peters Surgical to Advanced Medical Solutions Group plc. As a majority shareholder since 2013, Eurazeo, has supported Peters Surgical in its transformation to become a leader in specialty surgery – extended product range, expanded geographical presence, increased direct-selling capabilities and expanded industrial presence to better serve US, Asian and European markets. The transaction generated proceeds of €66 million, including €46 million for Eurazeo. It remains subject to several earn-outs which could be paid in 2025;

- ▰sale of I-TRACING, the leading French managed security service provider (MSSP), to Oakley Capital. The company was valued at more than €500 million as part of this transaction. Eurazeo’s invested capital yielded a cash-on-cash multiple of 3.0x and an internal rate of return of 38%. A leading shareholder since 2021, Eurazeo will continue to support the Group in co-control with Oakley Capital by reinvesting €180 million in commitments through a continuation fund, raised from new institutional investors as well as the historical Limited Partners of the Small-mid activity. The continuation fund was scoped to enable I-TRACING to benefit from significant financing capacities to support its development plan, including an ambitious buy-and-build strategy in Europe;

- ▰investment in Rydoo, a leading global provider of expense management software headquartered in Belgium. Rydoo provides an SaaS solution to automate and optimize expense management and processing, used by over 3,000 businesses in 132 countries. The transaction, the ninth investment for Eurazeo PME IV, forms part of the strategy of supporting European technology and B2B services’ SMEs in their international expansion.

Eurazeo Planetary Boundaries Fund (EPBF)

In May, Eurazeo launched Eurazeo Planetary Boundaries Fund (EPBF), an impact buyout fund designed to scale profitable environmental solutions to reverse or adapt to the overstepping of Planetary Boundaries while delivering best-in-class buyout returns.

- ▰EPBF has a target size of at least €750 million. The team comprises private equity professionals and environmental experts. A portion of the carried interest will be linked to achieving key performance indicators. EPBF will center its investment strategy on two primary themes – boosting a regenerative and circular economy, and championing solutions for transition and adaptation. The fund will invest in small to mid-market companies, primarily in Europe, in order to scale them up through ambitious buy and build strategies, across sectors such as agriculture and food, waste and packaging, water management, low-carbon energy, and transport services. EPBF aims to unlock an unrivalled category of buyout impact investment in order to drive best-in-class performance.

Growth Equity

Growth activity in 2024 confirmed Eurazeo’s key role in supporting highly strategic European technology companies and transforming them into global champions, with one of the largest and most active pan-European teams dedicated to financing scale-ups across the continent.

- ▰sale of Eurazeo’s stake in LumApps, leader in SaaS intranet Employee Experience solutions, to Bridgepoint. LumApps’ main shareholder with a stake in over 30% of the company, Eurazeo has supported the company since 2017, with successive reinvestments in 2018 and 2019 to finance its international development. The transaction should generate over €210 million, with cash-on-cash multiples of nearly 9x for the Venture strategy and 4.4x for the Growth strategy;

- ▰sale of its stake in Klaxoon, a leading visual collaboration tools platform, to Wrike, a US group specializing in intelligent work management and portfolio company of the US investment fund Symphony Technology Group (STG);

- ▰investment in EcoVadis, the world’s leading CSR rating platform. EcoVadis forms part of our Climate Solutions vertical, which offers a technological solution to create reliable ESG assessments and thus obtain a high return on investment and a positive climate impact for their clients;

- ▰investment in Cognigy, a global leader in AI-driven customer services, for an amount of €50 million in Series C funding. Cognigy uses advanced AI to deliver exceptional and personalized customer service in any language and on any channel.

Venture

The Venture activity in 2024 was marked by strategic investments and successful divestments, confirming Eurazeo’s key role in supporting high-potential digital companies and in new technologies and digital innovation for sustainable cities.

- ▰sale of Eurazeo’s stake in Onfido, a biometric authentication and identity verification company, recording a cash-on-cash multiple of approximately 4.0x;

- ▰WeRide, which has become a global leader in autonomous vehicles and been supported by Eurazeo since its A Series in 2018, was successfully listed on the Nasdaq, with a valuation of US$4.21 billion;

- ▰investment in a €26 million fundraising for MATERRUP, a company that has developed an innovative low-carbon and circular cement technology. This fundraising aims to accelerate the deployment of MATERRUP plants in France and Europe.

Healthcare

The Healthcare business was marked in 2024 by major advances in fundraising, divestments and targeted investments. These achievements reflect the Group’s ambition to support therapeutic innovation and confirm a dynamic and committed strategy for leading-edge healthcare companies.

- ▰co-investment of the Nov Santé Actions Non Cotées fund – managed by Eurazeo and dedicated to the development of healthcare sectors in France, at the initiative of France Assureurs and the Caisse des Dépôts – and Kurma Partners – Eurazeo’s healthcare Venture subsidiary in Pantera as part of its €93 million fundraising. Pantera aims to produce Actinium-225 on a large scale, a radioisotope that has particularly promising features to combat certain cancers and leukemias.

Secondaries

The Private Funds Group activity specializes in the creation of diversified portfolios, providing privileged access to the top performing and most qualitative Private Equity funds. Since 2001, the team has invested more than €6.5 billion through 32 vehicles in three strategies (Primary, Secondary and Co-investment).

- ▰the team again won the Best French LP: GP Led Continuation Funds award at the Private Equity Exchange & Awards organized by Décideurs Corporate Finance. This award is a recognition of the team’s ability to structure complex transactions to provide its clients with the best market opportunities.

Private debt

Eurazeo’s Private Debt activity furthered its international growth momentum in 2024 with the opening of a 5th office in Milan, in addition to offices in Paris, London, Frankfurt and Madrid. This set of local offices enables teams to support portfolio companies in these fast-growing locations. Eurazeo Private Debt was one of the most active lenders in Europe in 2024. The team invested over €2.1 billion, including more than 60% outside France.

- ▰EPD VII fundraising with nearly €2 billion raised at the end of December 2024;

- ▰investment in the Eurazeo Private Value Europe 3 Evergreen fund, raised from private clients. This fund is now the largest European retail fund, reaching nearly €2.7 billion;

- ▰support for Sagard in acquiring Venpa, an Italian specialist in the rental of aerial platforms;

- ▰financing of the external growth strategy of the German company Salestech accompanied by Quadriga Capital, supplier of technologies specializing in the digitization of sales and marketing processes;

- ▰supporting Capital Croissance in acquiring a stake in Synalp, a major wealth management consulting player in the Rhone-Alpes region;

- ▰nine transactions completed in 2024 under the Article 9 infra debt fund, Eurazeo Sustainable Maritime Infrastructure (ESMI). These investments bring the number of transactions in ESMI’s portfolio to 14 and enabled the fund to attain a 75% deployment rate at the end of December 2024;

- ▰through the Flex Financing activity, investment in a deal enabling the Berkem Group, specializing in plant chemistry, to exit the listing and regain its independence to enter a new development phase.

Real assets

Infrastructure

- ▰final close of the transition infrastructure program, comprising the Eurazeo Transition Infrastructure Fund (ETIF) and a co-investment vehicle, at €706 million, exceeding the initial €500 million target by 40%. This success, in only 20 months, reflects the strong investor demand for strategy focused on the transition to a low-carbon economy.

- ▰additional investment in Electra, a fast-charging specialist, as part of a €304 million fundraising. Since Eurazeo acquired a stake as a leading investor in June 2022, Electra has grown rapidly, expanding into 8 European countries and deploying around 1,000 charging terminals.

Real Estate

2024, the 10th year of Eurazeo’s Real Estate strategy, was marked by the launch of the new Eurazeo Operational Real Estate (EZORE) fund and the appointment of Riccardo Abello and Pierre Larivière as Partners, Co-Heads of this activity. Supported by Renaud Haberkorn who was appointed Senior Partner, the team continued to roll out its investment strategy focused on operational platforms operating own real estate assets in Europe.

- ▰sale of a portfolio of 22 hotels located in France by Grape Hospitality, 70% owned by Eurazeo, to a consortium set up by a hotel operator and a real estate investor. This transaction enables Grape Hospitality to sell most of its business division and focus further on upper midscale and upscale segments. Founded in 2016, Grape Hospitality operates 107 hotels, totaling more than 10,000 rooms across 7 European countries.

- ▰Eurazeo completed strategic recruitments within its Investor Relations team, led by Mathieu Teisseire, Managing Partner and member of the Eurazeo Management Committee:

-

2.2Value creation

▰ Investment portfolio net value, value creation and assets under management

Solid overall value growth in buyout, largely offset by further declines in the growth portfolio and fair value adjustments for certain mature investments in the MLBO and SMBO portfolios

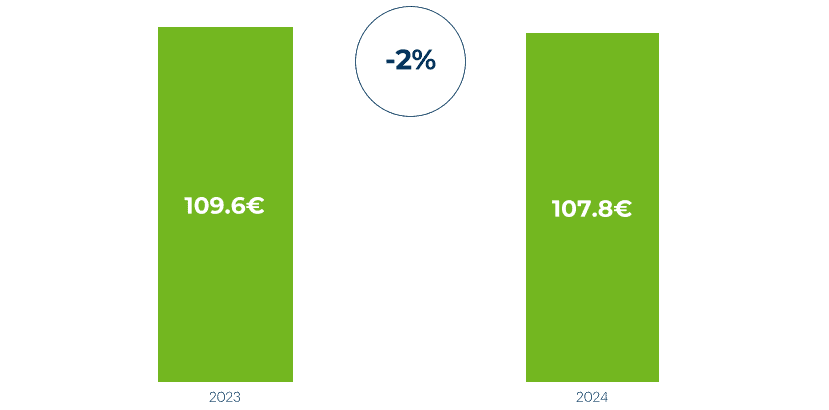

Portfolio value per share

As of December 31, 2024, the net value of the investment portfolio was €7,876 million. The portfolio value per share was €107.8 (compared to €109.6 as of December 31, 2023).

- ▰the -€323 million (-4%) decrease in the portfolio fair value, recognized in the P&L;

- ▰management fees of -€60 million (-1%) invoiced by Eurazeo management companies, recognized in P&L;

- ▰a scope effect of -€60 million (-1%) due to exits;

- ▰a positive share buyback impact (+4%)

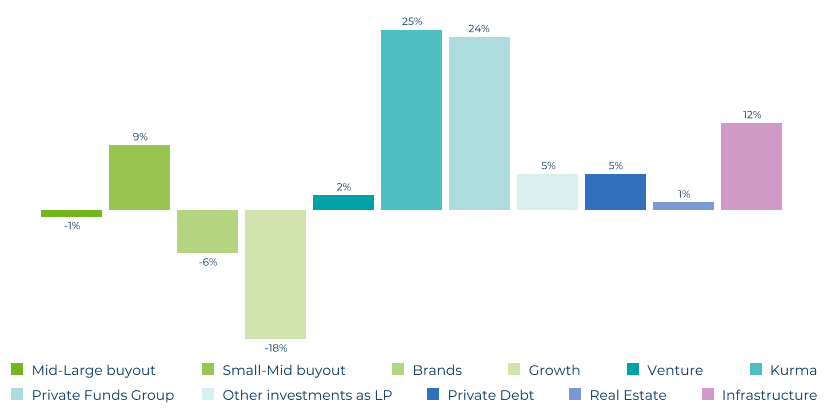

Portfolio value creation by investment division

The overall value dropped by €323 million (-4%) due to decline in the Growth (-€357 million) and Brands US (-€59 million) portfolios but also from separate investments of MLBO, Worldstrides (-€275 million) and SMBO, 2Ride (-€57 million). However, the value of the remaining portfolio rose by €497 million (+10%), with a significant increase in Buyout of €465 million (+12%).

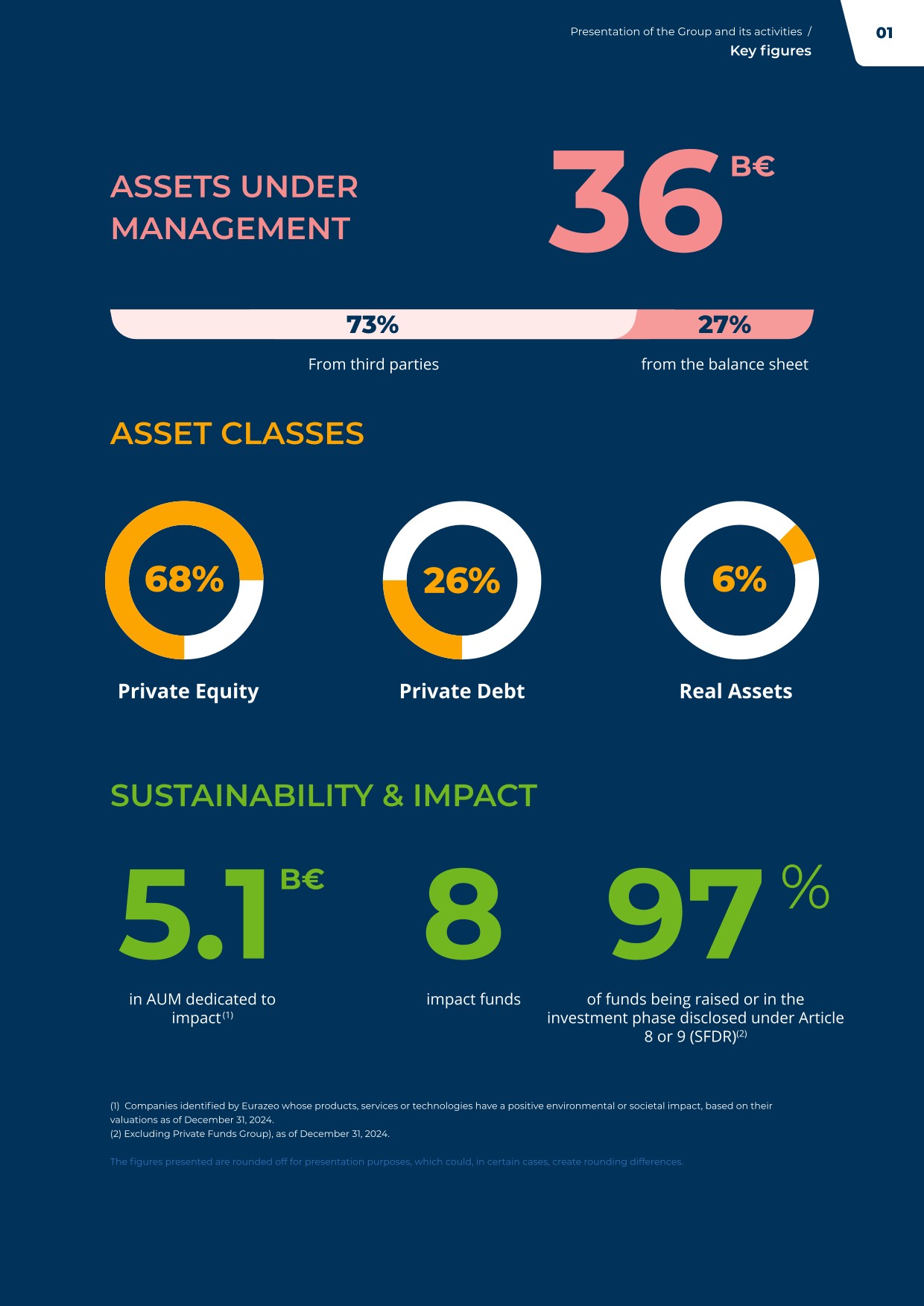

Assets Under Management

As of December 31, 2024, Eurazeo group Assets Under Management (AUM) totaled €36.1 billion, up 4% over 12 months, and break down as follows:

(In millions of euros)

12/31/2023 – Pro Forma MCH GP Exit

12/31/2024

Third-party AUM

Eurazeo balance sheet AUM

Total AUM

Third-party AUM

Eurazeo balance sheet AUM

Total AUM

Private Equity

15,987

9,187

25,174

16,433

8,314

24,746

Mid-large buyout

3,085

4,747

7,833

3,270

4,247

7,517

Small-mid buyout

1,467

997

2,463

1,649

829

2,478

Brands

-

781

781

3

754

757

Healthcare (Nov Santé)

418

-

418

415

1

416

Growth

2,527

2,037

4,564

2,177

1,772

3,949

Venture

3,129

129

3,258

2,666

132

2,798

Kurma

457

53

510

518

99

617

Private Funds Group

4,904

274

5,179

5,701

308

6,009

Impact

-

-

-

34

100

134

Other

-

169

169

-

72

72

Private Debt

7,117

363

7,479

8,805

424

9,229

Real Assets

771

1,169

1,939

945

1,181

2,126

TOTAL

23,874

10,718

34,592

26,183

9,919

36,102

-

2.3Subsequent events

At the end of February 2025, Eurazeo’s Real Estate team announced the acquisition of a majority stake in the Italian thermal park operator, Aquardens. This transaction marks the first investment of the EZORE fund, launched in December 2024. The Group also announced, through its Mid-large buyout team, the acquisition of a majority stake in Mapal, a pan-European leader in software for the hospitality sector.

In early March, the Group announced a first close with €300 million secured for the Article 9 buyout fund, the "Eurazeo Planetary Boundaries Fund" (EPBF). The fund has also announced its first acquisition, Bioline Agroscience, which offers a range of biological control solutions for pest insects in numerous crops.

-

3.1General Disclosures [ESRS 2]

▰3.1.1Basis of preparation for the Voluntary Sustainability Statement

3.1.1.1General basis for the preparation of sustainability statements [BP-1]

Voluntary report

In accordance with IFRS 10, Eurazeo’s consolidated average workforce was below the applicable threshold of 500 employees for two consecutive fiscal years (2022 and 2023). Nevertheless, Eurazeo has decided to publish a voluntary sustainability statement, which complies with the European Corporate Sustainability Reporting Directive (CSRD) requirements, and subject it to an assurance engagement by Statutory Auditors.

The assurance report will have an ad hoc format, which is different from the statutory report, and take the form of an ISAE 3000 limited assurance report. It will cover the following verifications: compliance of disclosures with the European Sustainability Reporting Standards (ESRS) and compliance of the reporting identification process with the ESRS. The report is available in Section 3.5.

This voluntary sustainability statement was prepared in connection with the first-time application of the regulation, which features uncertainties about the interpretation of the regulatory texts, the absence of established practices to refer to or comparative data, and difficulties in collecting data, particularly within the value chain. In this context, Eurazeo has applied the normative requirements set by the ESRS, as they apply on the voluntary sustainability statement preparation date based on the information available within its preparation deadlines.

Scope

This report has been prepared on a consolidated basis and covers the scope of the consolidated financial statements as presented in Chapter 6, Section 6.1 of the Universal Registration Document (URD), i.e. a scope comprising a total workforce of 562 employees in 13 countries as of December 31, 2024. Eurazeo has 456 employees in 11 countries. iM Global Partner (“iMGP”) has 106 employees in 9 countries.

The narrative elements presented in the report under the heading “Eurazeo” cover the following entities: Eurazeo SE, the portfolio management companies Eurazeo Funds Management Luxembourg (EFML), Eurazeo Global investor (EGI), Eurazeo Infrastructure Partners (EIP), and their offices abroad. These entities account for 99% of assets under management as of December 31, 2024. Kurma Partners and iMGP have implemented their own policies, actions and objectives. Those relating to Kurma Partners have not been included in this report due to their limited representativeness and the absence of impacts, risks and opportunities different from those of Eurazeo. Those related to iMGP are presented in the dedicated sections for each material ESRS.

The quantitative elements presented in the report under the heading “Eurazeo” cover the activities of the investment company Eurazeo SE, the portfolio management companies EFML, EGI, EIP, Kurma Partners and their offices abroad. The quantitative elements presented under the heading “iMGP” cover the activities of iMGP. The quantitative elements under the heading “Total” reflect the aggregation of Eurazeo and iMGP results.

Double materiality analysis

Eurazeo performed a double materiality analysis on its own operations, namely its investment company activity, and on its upstream and downstream value chain, which includes all financed companies. Eurazeo has identified material impacts, risks and opportunities (IRO) with regard to its activity and the expectations of its stakeholders. This information is detailed in this report in Section 3.1.4. In Section 3.1.3.3, the scope of IROs is specified in the column “Applicable (Eurazeo and/or iMGP).” The results of the double materiality analysis will be re-assessed in forthcoming years according to changes in methodologies, available data, the regulatory framework and, in particular, any voluntary standards established by the European Financial Reporting Advisory Group (EFRAG).

Disclosures presented

This report contains estimated information for Scope 3 upstream (suppliers) and downstream (investments) GHG emissions, which creates uncertainty and affects data accuracy. For example, in the absence of actual data, carbon emissions related to investments are calculated by cross-checking the company’s revenue with the emission factor related to its sector of activity. For the sake of transparency, the percentage of estimated data is specified. Emission factors are derived from reference databases: the Ademe and the International Energy Agency for own operations emissions and the Carbon Disclosure Project (CDP) for financed emissions. The methodology used to calculate Scope 3 is detailed in Section 3.2.1.7. Apart from Scope 3 emissions, the data in the report presents a limited risk of inaccuracy.

In accordance with the regulation (1), Eurazeo has chosen not to disclose certain information, which could have infringed on business confidentiality.

Taxonomy

As the portfolio companies of managed alternative investment funds are not themselves subject to Article 8 of the Taxonomy Regulation, Eurazeo was unable to produce the percentage of eligible investments (revenue, Opex, Capex) aligned with the European Taxonomy. Eurazeo has opted for a prudent approach that excludes the use of estimated data that has proved to be either non-existent, incomplete or unreliable.

3.1.1.2Disclosures in relation to specific circumstances [BP-2]

Time horizons

The time horizons used are aligned with standard recommendations. Therefore, the short-term horizon corresponds to the reporting period of this voluntary sustainability statement, the medium-term horizon covers a period of up to five years after this reporting period, and the long-term horizon extends beyond 5 years.

Disclosures stemming from other legislation or generally accepted sustainability reporting pronouncements

The voluntary sustainability statement incorporates information required by French or European regulations such as the Copé-Zimmermann Act, the Sustainable Finance Disclosure Regulation (SFDR) or the Task Force on Climate-related Financial Disclosure (TCFD).

Incorporation by reference

To facilitate the reading of the voluntary sustainability statement, Eurazeo incorporates certain information by reference summarized in the table below.

Description of how the business model and strategy take into account impacts relating to sustainability matters deemed material

Eurazeo incorporates sustainability matters into its business model to ensure its resilience and performance in the short, medium and long term. This approach is used to limit exposure to risks (physical, fiduciary, regulatory and reputational) and seize market opportunities to identify resilient companies with high growth potential. Its sustainability and impact strategy, O+, addresses environmental and social priorities, both their causes and effects, and engages Eurazeo and its entire value chain. It is a key differentiating factor for Eurazeo, both for investors who entrust it with their capital and for companies that entrust it with their growth. The inclusion of sustainability matters in the business model is presented in Chapter 1.

Description of targets in relation to sustainability matters deemed material and the progress made toward achieving these objectives

Eurazeo’s sustainability and impact strategy, O+, is built around two key commitments: Safeguarding planetary boundaries (O) and acting for a fairer society (+). In this context, Eurazeo has set ambitious environmental and social goals, and relies on world-renowned frameworks and initiatives (e.g. Science Based Targets initiative for decarbonization). These are detailed in Sections 3.2.1 and 3.3.1, respectively. Eurazeo reports annually on its progress in the URD and its O+ progress report.

Description of policies relating to sustainability matters

Policy

Entity-specific

Climate change

Biodiversity

Eurazeo workforce

Workers in the value chain

Consumers and end-users

Governance

Exclusion Policy

●

●

●

●

●

●

Infrastructure - Appendix to the Exclusion Policy

●

●

Responsible Investment Policy

●

●

●

●

Sustainability Risk Integration Policy

●

●

●

Code of Conduct

●

●

●

Diversity, Equity and Inclusion Policy

●

Compensation Policy

●

Human Rights Policy

●

●

Code of Conduct for Commercial Relations

●

●

Responsible Sales and Marketing Policy

●

Voting Rights Policy

●

Eurazeo Personal Data Protection Policy

●

●

Description of actions taken to identify, monitor, prevent, mitigate, remediate or bring an end to actual or potential adverse impacts, and the outcome of those actions

The strategies, programs and policies set up by Eurazeo are used to identify, monitor, prevent, mitigate or remediate sustainability IROs. These measures are described in the designated sections of this report.

Description of indicators relating to sustainability matters deemed relevant

-

3.2Environment

▰3.2.1Climate change [ESRS E1]

The table below lists the impacts and opportunities related to climate change considered material resulting from the double materiality analysis, as described in Section 3.1.4.1.

Presence in the value chain

Time horizon

IRO

Upstream

Own operations

Downstream

Short term

Medium term

Long term

Climate change mitigation and energy

Negative impact on climate change resulting from own operations

●

●

Climate change mitigation and energy

Negative impact from investments negatively affecting climate change mitigation

●

●

Climate change mitigation and energy

Positive impact from investments contributing to the fight against climate change

●

●

Climate change mitigation and energy

Positive impact resulting from Eurazeo’s engagement program to mitigate climate change

●

●

Climate change mitigation and energy

Opportunity related to the increased resilience of portfolio companies through Eurazeo’s engagement program to mitigate climate change

●

●

3.2.1.1Integration of sustainability-related performance in incentive schemes [GOV-3]

The integration of sustainability-related performance in incentive schemes is explained in detail in Section 3.1.2.3.

3.2.1.2Climate change mitigation transition plan [E1-1]

As early as 2014, Eurazeo defined a strategy to mitigate climate change. This strategy reflects Eurazeo’s ambition to reduce its negative impact on climate change regarding its own operations and across all its asset classes. Eurazeo has set up the necessary procedures and strategies to take into account climate issues for its own operations and its value chain. Furthermore, Eurazeo is currently drafting its transition plan.

3.2.1.3Material impacts, risks and opportunities and their interaction with strategy and business model [SBM-3]

Eurazeo has identified several impacts and opportunities related to climate change for its own operations and within its value chain. To date, Eurazeo has not identified any material physical or transition risk that could have a material financial or reputational impact. Eurazeo’s business model, as described in Chapter 1, its sustainability and impact strategy and the diversification of its portfolio help to significantly limit the occurrence or magnitude of such risks.

Climate change resilience strategy

Eurazeo’s climate strategy has been designed to ensure its business model is resilient to climate change. As such, it covers its own operations and its value chain, including its investments. It addresses all the IROs presented above.

As part of its O+ sustainability and impact strategy, Eurazeo has pledged to make its operations compatible with a net zero emissions world by 2040. This will be achieved through two action levers:

Eurazeo finances companies that contribute to climate change mitigation and adaptation through their products, services or technologies (as defined by IPCC working group 3 in its sixth assessment report on climate change (6)). More specifically, it invests in companies that significantly reduce or avoid greenhouse gas (GHG) emissions in sectors such as electric mobility, agricultural transition, thermal insulation, the circular economy, hydrogen, etc. and develops dedicated impact funds. At the end of 2024, €2.1 billion in assets under management were dedicated to these investments, distributed across generalist and impact funds, as described in Section 3.3.3.3.

Eurazeo has pledged to align its activities with the goals of the Paris Agreement to limit the temperature rise to 1.5°C. It has set ambitious goals for its own operations and its portfolio companies, validated in 202 by the Science Based Targets initiative (SBTi). They are presented in Section 3.2.1.6.

Eurazeo’s climate commitments include three steps: measuring the carbon footprint, defining and deploying decarbonization roadmaps in line with the Paris Agreement and measuring the progress achieved on a yearly basis. These commitments apply to Eurazeo and the portfolio companies for which Eurazeo has set up a support program. It includes methodological assistance provided by its climate-specialist operating partners, technological tools, a selection of first-rate service providers and financial support.

Eurazeo’s climate commitments are public and its progress on decarbonization is disclosed annually in its various Sustainability and Impact publications.

How and when the resilience analysis was performed

Eurazeo has integrated climate change issues since 2008, when the first carbon footprint of its portfolio was assessed. Since then, Eurazeo has extended this impact metric, supplemented by a risk and opportunity assessment, to its own operations and value chain.

The resilience of Eurazeo’s own operations and portfolio is analyzed annually, and on an ad hoc basis for each investment file, for three separate time horizons:

- ▰short term, covering a period of 1 to 3 years, the climate change risk assessment focuses mainly on complying with regulatory requirements, taking out insurance to cover identified physical risks and defining a decarbonization pathway aligned with the Paris Agreement. Depending on the location and nature of the Company’s business, a transition plan can also be defined;

- ▰medium-term, which spans a period of 4 to 10 years, aims to permanently integrate responsible practices into Eurazeo’s own operations and those of the portfolio companies. This mainly includes the deployment of a decarbonization pathway, and, where appropriate, a transition plan, with their transcription into CapEx and OpEx; and

- ▰long term, which exceeds 10 years, when it is possible to anticipate and prepare for the probable impacts of climate change. This may require Research & Development (R&D) projects to develop products, services and technologies addressing new requirements or adapting to a more critical environmental situation.

Description of the results of the resilience analysis

Eurazeo did not identify any material climate change risk that could negatively impact its financial performance either for its own operations or its investments. Since the latter are highly diversified with average holding periods of 3 to 7 years depending on the asset class, climate change risks are limited.

3.2.1.4Policies related to climate change mitigation [E1-2]

Climate issues are addressed in the Exclusion Policy, the Responsible Investment Policy, the Sustainability Risk Integration Policy and the O+ strategy, which defines ambitious targets. These policies apply to all asset classes. Their implementation is overseen by Sophie Flak, Executive Board member and Managing Partner, Sustainability & Impact. In connection with this voluntary report, the roll-out of the Exclusion Policy and the Responsible Investment policy is verified annually by Statutory Auditors. The results are presented in Section 3.1.3.1. Eurazeo has not formalized a dedicated climate change mitigation policy.

3.2.1.5Actions and resources in relation to climate change policies [E1-3]

To achieve its climate objectives, Eurazeo has defined and rolled out an action plan for its own operations and assist its portfolio companies in their decarbonization efforts.

At Eurazeo level

Eurazeo was one of the first Private Equity players in Europe to commit, as of 2020, to defining a decarbonization pathway in accordance with the Paris Agreement.

The decarbonization targets for its own operations cover Scope 1 and 2 emissions validated by the SBTi and Scope 3 emissions excluding investments.

- ▰Scope 1: gradual renewal of the vehicle fleet in favor of electric vehicles;

- ▰Scope 2: energy efficiency program for the new Paris premises (see below), purchase of renewable electricity or use of renewable energy certificates;

- ▰Scope 3.1 (Purchased goods and services): an engagement campaign for the main suppliers, representing 50% of Eurazeo’s annual purchases (2024);

- ▰Scope 3.2 (Capital goods): implementation of an action plan to reduce the footprint of our IT and technology infrastructures; and

- ▰Scope 3.6 (Business travel): Sustainable business travel recommendations.

At the end of 2024, Eurazeo inaugurated its new headquarters at rue Pierre Charron in Paris. The project, which consisted in completely refurbishing an existing building, is fully in line with a Paris Agreement compliant pathway and complies with the sector’s most stringent environmental standards. Accordingly, the “66 Charron” building obtained an excellent score in the NF HQE Sustainable Building and BREEAM (Building Research Establishment Environmental Assessment Method) certifications. It also meets the objectives of the French tertiary decree by 2030, aiming to reduce energy consumption in office buildings by 40%; and it is already well positioned to achieve the 50% target for 2040. The building’s heating and cooling system is based on innovative technology, using the Peltier effect (7), which reduces greenhouse gas emissions by approximately 30% compared to a traditional solution, while optimizing the quality of the distributed air.

Eurazeo strengthens its commitment to climate change mitigation by adopting additional measures. Since 2019, Eurazeo has indexed sustainability criteria to its syndicated credit line in order to support carbon contribution projects every year. In 2024, this initiative helped finance two projects located in the French départements of Pas-de-Calais and Puy-de-Dôme. Certified with the Low Carbon Label, these projects will help store and reduce 1,444 tCO2eq by 2030, while promoting long-term carbon sequestration in soils. By 2055, these two projects will have helped store and reduce 5,776 tCO2eq.

At the portfolio company level

Eurazeo has developed 4 impact funds to address the critical environmental issues described in Section 3.3.3.5.

Eurazeo’s Exclusion Policy prohibits investments in sectors with a major environmental impact, in particular those related to fossil fuels. By aligning its investments with high standards of environmental sustainability, Eurazeo strengthens its impact to mitigate climate change and more generally preserve planetary boundaries and safeguards against transition risks that could result in a significant loss of value.

Identifying and assessing climate risks in the due diligence phase: assessing the climate risks of potential investments covers both physical risks, such as extreme weather events or reduced natural resource availability, and transition risks, such as regulatory developments or changes in consumer behavior. Eurazeo has equipped itself with tools backed by leading databases to identify and assess these risks and integrate their financial impact into the acquisition business plan.

Considering climate issues in the investment decision-making: investment teams incorporate climate risk assessment into their decision-making process and the Investment Committee reviews compliance with the Exclusion Policy and the conclusions of climate-related sustainability due diligence procedures, which are prerequisites for investment approval.

Anticipating the risk of a generalized carbon tax: to prevent regulatory transition risks, Eurazeo assesses the impacts of public policies on its investments, including the implementation of carbon taxes or stringent energy performance regulations that could have an impact on the financial performance of portfolio companies. Eurazeo has acquired a tool to identify and assess these risks and supports its companies in rolling out transition plans to ensure their competitiveness and resilience when faced with these challenges.

Integration into legal documentation and financing: climate-related commitments are included in shareholders’ agreements in which clauses provide for annual reporting, measuring impacts, risks and opportunities associated with climate change and defining action plans to address them. Eurazeo also includes climate-related objectives in its financing to encourage companies to decarbonize their activities. In 2024, 100% of financing included a decarbonization target and 98% of legal documents contained sustainability clauses.

During the investment period, Eurazeo adopts an active and structured approach to integrate climate change issues into its portfolio companies. The aim is twofold: reduce their risk exposure and limit their own negative impact. The main actions are as follows:

- ▰measure Scope 1, 2 and 3 GHG emissions annually;

- ▰define and deploy a decarbonization pathway aligned with the Paris Agreement.

3.2.1.6Targets related to climate change mitigation [E1-4]

To ensure that decarbonization occurs in sufficient proportions and at the pace required to meet the Paris Agreement goals, Eurazeo made a commitment in 2020 to the Science Based Targets initiative (SBTI). Since SBTi eligibility scopes and methodologies do not cover all Eurazeo’s own operations or investments, additional objectives were defined.

At Eurazeo level

- 1)55% reduction in Scope 1 and 2 GHG emissions in absolute value by 2030 (base year: 2017; baseline value 135 tCO2eq) – target validated by SBTi;

- 2)80% annual renewable electricity supply by 2025 (base year: 2017; baseline value 9%) – target validated by SBTi; and

- 3)30% reduction in Scope 3 GHG emissions in absolute value by 2030 (base year: 2019; baseline value 6,945 tCO2eq).

Eurazeo’s scope 3 GHG emissions related to purchased goods and services, IT capital goods, waste generated in operations, business travel and employee commuting are not included in the SBTi scope as they have a reduced materiality in relation to its Scope 3 when including financed emissions.

At the portfolio company level

Eurazeo seeks to encourage all of its portfolio companies to adopt a decarbonization approach aligned with the Paris Agreement. According to available methodologies and SBTi eligibility scopes, Eurazeo has defined decarbonization targets for its portfolio:

- 1)For the Real Estate portfolio: 60% reduction in Scope 1 and 2 GHG emissions per square meter by 2030 (base year 2021); and

- 2)For the Eligible Private Equity portfolio (8): 100% of invested capital with targets validated by SBTi by 2030, with an intermediate target of 25% by 2025.

Summary of climate-related targets

Baseline value

Base year

Target value

Target year

Own operations

Reduction in Eurazeo GHG Scope 1 and 2 emissions

135 tCO2eq

2017

61 tCO2eq (-55%)

2030

Annual renewable electricity supply

9%

2017

80%

2025

Reduction in Eurazeo GHG Scope 3 emissions (excluding financed emissions)

6,945 tCO2eq

2019

4,862 tCO2eq (-30%)

2030

Investment portfolio

Real Estate: reduction in GHG emissions per square meter

Not applicable

2021

60% reduction

2030

Eligible Private Equity portfolio: percentage of capital invested with targets validated by SBTi

Not applicable

2021

100%

2030

Intermediate target of 25% by 2025

3.2.1.7Gross Scopes 1, 2, 3 and Total GHG emissions [E1-6]

At Eurazeo level - Progress in 2024

Scope 1 and 2 GHG emissions increased from 96 tCO2eq in 2023 to 126 tCO2eq in 2024 (Scope 2 expressed in market-based). This 31% increase was attributable to the relocation of the two main offices in 2024 to a new shared space, resulting in a temporary doubling of office space in 2024. As the former premises have now been returned, this increase in emissions is cyclical and will disappear in 2025. At a constant office scope, Scope 1 and 2 emissions would have been 82 tCO2eq in 2024, a decrease of 15% compared to 2023.

Since 2017, the base year, Eurazeo has reduced its Scope 1 and 2 emissions by 27% in absolute value. The 55% reduction target should be reached in 2025, supported by the return of the former premises.

For the second year running, Eurazeo has increased its electricity consumption from renewable sources above its 80% target, with 98% in 2024 (vs. 96% in 2023).

At the portfolio company level - Progress in 2024 (9):

- ▰51% of companies completed their Scope 1, 2 and 3 GHG emission assessment with actual data (vs. 49% in 2023), representing 67% of the portfolio value;

- ▰51% implemented carbon reduction initiatives (vs. 38% in 2023), representing 66% of the portfolio value;

- ▰18% have defined a Paris Agreement aligned decarbonization pathway, representing 38% of the portfolio value;

- ▰9% have made an SBTi commitment (vs. 4% in 2023), representing 29% of the portfolio value; and

- ▰5% have had their decarbonization targets validated by SBTi (vs. 2% in 2023), representing 13% of the portfolio value.

At the end of 2024, 41% of portfolio companies (10) (expressed in capital invested) had launched the process (vs. 30% in 2023). 12% of these companies had submitted their pathway (vs. 3% in 2023), and 14% had their decarbonization targets formally validated by SBTi (vs. 4% in 2023).

Gross Scope 1, 2, 3 and Total GHG emissions

Eurazeo

iMGP

Total

2024

2024

2024

Scope 1 GHG emissions

Gross Scope 1 GHG emissions (tCO2eq)

45

0

45

Percentage of scope 1 GHG emissions from regulated emission trading schemes (%)

0

0

0

Scope 2 GHG emissions

Gross Scope 2 GHG emissions (location-based) (tCO2eq)

227

478

705

Gross Scope 2 GHG emissions (market-based) (tCO2eq)

80

478

558

Scope 3 GHG emissions

Total Scope 3 GHG emissions (tCO2eq)

3,684,044

2,962

3,687,006

1 Purchased goods and services

8,224

2,707

10,931

2 Capital goods

69

0

69

3 Fuel and energy-related activities (not included in Scope1 or Scope 2)

71

43

114

4 Upstream transportation and distribution

NM

NM

NM

5 Waste generated in operations

18

10

28

6 Business travel

769

136

905

7 Employee commuting

232

66

298

8 Upstream leased assets

NM

NM

NM

9 Downstream transportation

NM

NM

NM

10 Processing of sold products

NM

NM

NM

11 Use of sold products

NM

NM

NM

12 End-of-life treatment of sold products

NM

NM

NM

13 Downstream leased assets

NM

NM

NM

14 Franchises

NM

NM

NM

15 Investments

3,674,661

NC

3,674,661

Total GHG emissions

Total GHG emissions (location-based) (tCO2eq)

3,684,316

3,440

3,687,756

Total GHG emissions (market-based) (tCO2eq)

3,684,169

3,440

3,687,609

NM: Not material. / NC: Not calculated.

Methodological clarifications

In 2024, Eurazeo improved the accuracy of its GHG emission assessment by adopting an approach based on the accounting statements of all its subsidiaries, while improving the level of detail for related emission factors and increasing the percentage of physical data used.

Eurazeo assesses its GHG emissions according to the GHG Protocol (or Greenhouse Gas Protocol), which provides standards and recommendations to account for GHG emissions.

- ▰market-based: Scope 2 emissions calculation method taking into account the Company’s supply contracts and other contractual instruments such as Energy Attribute Certificates (EAC);

- ▰location-based: Scope 2 emissions calculation method taking into account the average emissions related to electricity production in the area where it is consumed.

Due to the nature of its investment activity, Eurazeo has the particularity of having a Scope 3 divided into two parts:

- ▰indirect GHG emissions related to Eurazeo’s upstream and downstream value chain (9,383 tCO2eq. or 0.25% of total emissions), corresponding to the GHG Protocol to categories 1, 3, 5, 6 and 7 detailed in the table above. Category (4) Upstream transportation and distribution is excluded from Eurazeo’s Scope 3 emissions accounting. Emissions related to this category are accounted for in the category (1) Purchased goods and services. Categories 9, 10, 11 and 12 related to the use or end-of-life of sold products are excluded because they are irrelevant due to the service nature of Eurazeo’s business;

- ▰Scope 3 emissions related to Eurazeo’s investments (3,674,661 tCO2eq. or 99.7% of total emissions), corresponding to category 15 for Scope 3 emissions according to the GHG Protocol. The assessment of the portfolio’s GHG emissions covers all Scopes 1, 2 and 3 of the portfolio companies. It is based on actual data from companies that have assessed their GHG emissions over the last 3 years or on an estimate based on business sector monetary emission factors and their revenue. The total is calculated according to an attribution factor, a method in line with the recommendations of the Partnership for Carbon Accounting Financials (PCAF). Eurazeo included all emissions relating to deal fees, representing 3,967 tCO2eq. The issues of the fund-of-fund activity and part of the Asset Based (Debt) activity are excluded from the calculation scope.

GHG intensity

The table below presents the intensity of greenhouse gas emissions per million euros of revenue. It should be recalled that Scope 3 category 15 (Investment) represents 99.7% of Eurazeo’s total emissions. This category was not measured for iMGP in 2024.

GHG intensity per revenue

Unit

Eurazeo

iMGP

Total

Total GHG emissions (location-based) per revenue

tCO2eq/€M

12,489

39

9,629

Total GHG emissions (market-based) per revenue

tCO2eq/€M

12,489

39

9,628

Revenue used to calculate GHG intensity as of December 31(11)

€M

295

88

383

iM Global Partner

iMGP seeks to align with the Paris Agreement and the French national low-carbon strategy. The company has set up a greenhouse gas (GHG) reduction policy with the aim of identifying the main sources, implementing a reduction strategy, and steering an effective action plan whose results are communicated to internal and external stakeholders. The company has implemented several initiatives to reduce its carbon footprint such as encouraging soft mobility (public transport and rail when possible). For IT equipment, the company favors products with the longest warranty and the best repairability. Internally, iMGP educates its employees in sustainable practices through educational workshops focused on waste management, or reducing plastic consumption. These actions reflect the company’s commitment to limiting its direct climate-related impacts. To assess its carbon footprint, the company follows the GHG Protocol, which divides emissions into three categories: Scope 1, 2, and 3.

iMGP also seeks to identify and manage the climate-related risks related to its own operations in order to apply, if relevant, certain TCFD (Task Force on Climate-related Financial Disclosures) recommendations on climate engagement transparency. The company decided to support this initiative in 2022. In 2024, iMGP continued to analyze the 11 TCFD recommendations to assess the impacts and the level of commitment required by them to define those that would be applicable in 2025. In terms of governance, iMGP has set up an ESG group committee involving management, various departments (Finance, HR, Compliance, etc.) and the relevant offices (US and Europe) in order to monitor the effectiveness of the policies and actions to be implemented. An update on the status of the various measures in progress is presented to each ESG Committee meeting to ensure that implementation deadlines are met.

At investment level, iMGP has implemented an ESG policy that includes criteria for assessing environmental risks during pre-acquisition due diligence phases on the managers in which it wishes to hold a minority interest. Post-acquisition, iMGP incorporates these issues by conducting an annual due diligence to identify their areas of improvement and discuss their non-financial management with them. In managing its funds, iMGP assists partner managers in implementing ESG criteria in their investment strategy. Funds disclosing information in connection with their Article 8 and/or Article 9 classification now select underlying instruments that are themselves aligned with the SFDR. These funds may contribute in part to the environmental targets set out in the EU climate taxonomy regulation. Given the difficulty in being able to rely on reliable data, the management company did not adopt specific actions to manage the impacts, risks and opportunities related to climate change.

-

3.3Social

▰3.3.1Eurazeo own workforce [ESRS S1]

The table below lists the impacts and risks related to the Company’s own workforce considered material resulting from the double materiality analysis, as described in Section 3.1.4.1.

Presence in the value chain

Time horizon

IRO

Upstream

Own operations

Downstream

Short term

Medium term

Long term

Training and skills development, adequate wages

Positive impact relating to career and development prospects for employees and strong appeal on the labor market

●

●

Social dialogue

Reputational risk for the Group due to a deteriorated social climate or dialogue

●

●

Diversity

Negative impact generating attrition or lack of attractiveness in the absence of diversity, equity and inclusion policies, non-inclusive practices

●

●

Working conditions

Negative impact on the health, well-being and safety of employees due to poor working conditions

●

●

Working conditions

Negative impact on employee integrity in the event of discrimination, violence and/or harassment

●

●

3.3.1.1Material impacts, risks and opportunities and their interaction with strategy and business model [SBM-3]

Eurazeo places its employees at the core of its strategy and has identified potential impacts and risks related to its human capital as described in the table above. Eurazeo has pledged to overcome these challenges by maintaining best-in-class practices and guaranteeing an inclusive and fundamental rights-compliant working environment conducive to the development of its employees and their skills.

To promote the respect and well-being of its employees, the Company has set up a constructive social dialogue as well as various tailored processes.

Eurazeo considers its own workforce to be employees with whom it has a direct contractual relationship, thus excluding casual workers and outsourced services. These employees include permanent and temporary staff. In 2024, Eurazeo did not identify any non-employees in its workforce.

Workforce as of December 31, 2024 by type of contract and gender [S1-6]

Workforce as of December 31, 2024 by region [S1-6]

Eurazeo

iMGP

Total

Total number of permanent and temporary employees as of December 31

456

106

562

Germany

10

1

11

China

5

0

5

South Korea

3

0

3

Spain

2

2

4

United States

18

54

72

France

366

19

385

Italy

3

1

4

Luxembourg

10

11

21

Netherlands

1

0

1

United Kingdom

33

16

49

Singapore

5

0

5

Sweden

0

1

1

Switzerland

0

1

1

3.3.1.2Policies related to OWN workforce [S1-1]

Eurazeo has implemented several policies: a Diversity, Equity and Inclusion (DEI) Policy and Charter, a Compensation Policy and a Human Rights Policy. Eurazeo also has all employees sign a Code of Conduct, which prohibits any form of discrimination. These policies help manage the impacts, risks and opportunities associated with Eurazeo’s workforce as defined at the beginning of this section.

The policies apply to all Eurazeo employees in all geographical locations. Their implementation is overseen by the Human Resources Department as delegated by Executive Board members. These policies are available to all employees on Eurazeo’s website and Intranet. Eurazeo ensures the transparent communication of its policies to stakeholders. Every employee is thus required to sign the Code of Conduct.

Diversity, equity, inclusion policy

The Human Resources Department rolls out the HR strategy throughout the year, particularly with regard to diversity, equity and inclusion, applicable to all HR processes and actions (performance assessments, training programs, career management, recruitment, etc.).

Eurazeo’s policy focuses on a wide range of grounds for non-discrimination. It prohibits any form of discrimination based on gender, age, ethnicity, nationality, social origin, marital status, religion, sexual orientation, physical appearance, state of health, disability, state of pregnancy, union membership or political views. These practices seek to ensure equal opportunity for all its employees and candidates in terms of recruitment, access to training, remuneration, social protection and professional development.

Through these actions, Eurazeo is committed to complying with several standards or initiatives. For example, the Company has signed the Charter for Diversity, initiated by the France Invest association, and the Diversity in Action charter of the ILPA (Institutional Limited Partners Association).

Training plan

Eurazeo seeks to offer its employees the chance to unlock their potential, by constantly improving and evolving. With this in mind, each year Eurazeo develops a tailored training plan, adapted to each population (business line, position). It encompasses both hard and soft skills. The 2024 training plan is detailed in Section 3.3.1.5.

Compensation Policy

The Compensation Policy for members of the Eurazeo Executive Board is consistent with the AFEP-MEDEF recommendations (see Chapter 5, Section 5.8).

The fixed and variable compensation of all employees is reviewed annually and analyzed against internal tables based on a review of compensation in the markets where Eurazeo operates. Eurazeo firmly believes in allowing employees to benefit from growth in the Company’s earnings. Eurazeo therefore encourages the sharing of value creation, notably by granting long-term instruments. Employees are also eligible for collective compensation in the form of incentive and/or profit-sharing schemes in France.

Furthermore, sustainability criteria have been taken into account since 2014 to calculate the variable compensation of Executive Board members, and more particularly since 2020 when Eurazeo’s Sustainability & Impact strategy objectives were factored into the individual assessment representing 15% of this variable compensation (see Chapter 5, Section 5.8). Since 2019, sustainability criteria have also been taken into account to calculate the variable compensation of all Management Committee members with specific objectives depending on their scope of responsibility. This practice was extended to the investment team members of Article 9 (SFDR) classified funds in 2022 and to Managing Directors in 2023.

Human Rights Policy

In January 2022, Eurazeo published its Human Rights Policy, through which it explicitly prohibits any use of forced labor, child labor and trafficking of human beings. Eurazeo is committed to respecting human rights, ILO principles and the UN Guiding Principles on Business and Human Rights, ensuring a healthy working environment that respects human dignity.

3.3.1.3Processes for engaging with own workers and workers’ representatives about impacts [S1-2]

Dialogue is based on proximity between Management and employees, and the ability to hold discussions in an atmosphere of trust and transparency. Eurazeo focuses on implementing policies and measures to promote social dialogue. The Social and Economic Committees (SECs) in France hold monthly meetings to promote continuous dialogue and collective feedback from employees. In accordance with its legal obligations, Eurazeo informs and consults the SEC in France on several key topics, such as: working conditions, strategic directions, results, reorganization or restructuring projects, company social policy, training, health and safety, etc.

Following the merger of Eurazeo’s French management companies, social policies were harmonized in 2024 for all entity employees in France, mainly through discussions with the SECs. This harmonization included an alignment of processes with the main social policy components:

- ▰employee savings: set-up of a Group incentive agreement in fiscal year 2024;

- ▰collective agreement common to Eurazeo’s three French subsidiaries: that applicable to Financial Companies; and

- ▰signature of the amendment to the agreement on the organization of working time for the EGI and Eurazeo SE entities.

- ▰two employee representatives and a SEC representative participate in all Eurazeo Supervisory Board meetings as members and as a guest, respectively; and

- ▰employees in France are represented by the SECs relating to each legal entity (Eurazeo SE and EGI) in accordance with the legal provisions.

As part of a dialogue process, Eurazeo regularly conducts surveys to measure employee opinions on key topics.

Collective bargaining and social dialogue by region [S1-8]

Collective bargaining coverage(14)

Social dialogue(15)

Eurazeo

iMGP

Eurazeo

iMGP

Eurazeo

iMGP

Coverage rate of permanent and temporary employees as of December 31

Workforce - EEA(16)

Workforce - EEA

Workforce - Non-EEA

Workforce - Non-EEA

Workplace representation (EEA only)

Workplace representation (EEA only)

0 -20%

USA

USA

80 -100%

France

France

France

France

3.3.1.4Processes to remediate negative impacts and channels for own workers to raise concerns [S1-3]

Eurazeo fosters a relationship in which it listens to employees. In 2024, Eurazeo organized a People Survey by interviewing all employees. The results were communicated to all employees as well as the action plans implemented as a result of this survey.

In France, during the relocation to the new premises, a working group comprising employees was set up to gather their suggestions.

More generally, the Executive Board regularly communicates on strategy, highlights and results, and encourages the Management Committee and all team managers to do the same with the teams and ensure, through local management, that employees can express themselves.

3.3.1.5Taking action on material impacts on own workforce [S1-4]

Eurazeo rolls out various initiatives to guide its decisions and effectively manage the actual and potential impacts on its employees.

Eurazeo anticipates the needs of its employees in terms of jobs and skills in the short, medium and long term. Accordingly, the Human Resources Department has structured its practice into the following lines of action:

The HR Department supervises and accompanies Eurazeo’s development by annually identifying the recruitment needs of the various departments with managers and Executive Management. It determines the most appropriate recruitment channels, coordinates the process with managers and ensures that hired profiles are in line with skills requirements.

To facilitate the induction of new employees, interviews are organized with representatives of the teams with whom they will work. This process enables a better understanding of the business lines, the interactions between the various departments, their rights and obligations, thus accelerating their integration.

Since 2024, Eurazeo has organized an annual onboarding day for all new arrivals. This event includes a presentation of Eurazeo’s strategy by the CEOs, as well as talks by the heads of the main business categories (Investors, Investor Relations, Corporate functions, Operations, etc.). This format seeks to strengthen the commitment of new employees and their overall understanding of Eurazeo’s strategic challenges.

Eurazeo acts to develop the employability of all its employees via a training and skills development and assessment program and a career management scheme. These measures concern all employees in all locations.

In 2024, Eurazeo deployed a fully digitalized appraisal process using the Cornerstone tool, which enables a clear and structured sequencing in two stages:

- ▰self-appraisal, where each employee assesses their achievements and objectives met, thus allowing for prior personal reflection;

- ▰appraisal by the manager, who relies on the self-appraisal to conduct a constructive and in-depth discussion.

- ▰the mid-year appraisal, which is a discussion to assess the first half of the year. It is not a formal appraisal but is held to adjust priorities, give feedback, review progress thus far and identify any support needs; and

- ▰the year-end appraisal, which has a more formalized approach. Its objectives are to assess the past year’s overall performance (qualitative and quantitative assessments of objectives and competencies using a grid defined at company level) and define the objectives for the coming year plus the means of implementation (training, development initiatives).

Year-end performance appraisal [S1-13]

Eurazeo

iMGP

Total(17)

Percentage of permanent employees having participated in regular appraisals of their performance and career development as of December 31

80%

95%

88%

Women

75%

98%

87%

Men

84%

92%

88%

Eurazeo supports its employees throughout their career on matters related to their development. Human Resources Business Partners (HRBPs) are available to support them in their advancement and answer any questions concerning their career: career management (development, workload, individual topics, promotions), functional or geographical mobility, induction interviews during trial periods, feedback interviews for outgoing employees. The HRBPs also assist managers with their managerial duties.

- ▰training on behavioral skills, in particular on public speaking, leadership, technical skills related to the investment business: Private Equity fundamentals, investment in IT services;

- ▰a training course for junior investors with 4 sessions per year covering the main topics related to the business: financial due diligence, integration of Sustainability & Impact policy during the investment process, portfolio management and value creation, fund negotiation & structuring, market risks and issues;

- ▰a cycle of awareness-raising training courses on sustainability matters for Sustainability & Impact coordinators;

- ▰a cycle of mandatory and regulatory training courses set up with the Compliance (AMF, AMF ESG) and IT/Digital (cybersecurity, digital and IT fundamentals, Salesforce tool) teams;

- ▰specific training for each business line: KYC onboarding for Client Service teams, onboarding and training seminars per team (Operations, Compliance), specific level-based training, individual and collective coaching; and

- ▰mandatory safety training in France (fire warden).

Eurazeo also organizes individual training sessions to address upskilling needs identified during the appraisal process. Individual and collective coaching is also offered at key moments in an employee’s career (promotions and mobility, return from long absence, greater responsibilities etc.).

In 2024, Eurazeo continued to promote the online self-learning platform (Edflex), offering a comprehensive catalogue of training courses available in several languages on various topics such as IT, CSR, management & leadership, soft skills, languages and compliance.

Training hours by gender [S1-13]

Eurazeo

iMGP

Total(18)

Average number of training hours per permanent employee as of December 31 (hours / employee)

12.46

5.57

11.15

Women

14.89

4.86

13.10

Men

10.32

6.28

9.49

- ▰set-up of a Diversity, Equity and Inclusion Charter and Policy;

- ▰monitoring of quantified objectives set by Executive Management;

- ▰integration of the gender equality concept in HR processes;

- ▰agreements promoting an improved work/life balance and measures supporting parenting leave;

- ▰awareness-raising and training initiatives.

Eurazeo has set up specific procedures to prevent, mitigate and act on detected discrimination and promote diversity and inclusion. Eurazeo also implements a series of measures, including regular training and assessments, to promote diversity, equity and inclusion. Gender diversity objectives are applied to the governing bodies and specific measurement tools are used to monitor Eurazeo’s commitment to such objectives.

Eurazeo is committed to supporting its female employees in realizing their potential by developing specific training programs.

Eurazeo organizes external coaching and cross-mentoring programs, especially for women, in the Private Equity industry through Level20 sponsorship. Particular consideration is given to female employees during key moments of their career: e.g. when they come back to work from maternity leave or during promotions.

- ▰promotion of female applicants: in the recruitment process, the HR team ensures that the same number of men and women are put forward for available positions, especially at graduate level, where men and women are equally represented;

- ▰working with its peers and Private Equity professional associations to raise awareness and develop best practices in this area. Eurazeo has adhered to the diversity charters set up by SISTA, France Invest and the Institutional Limited Partners Association (ILPA);

- ▰support to the Florence Foundation: by supporting this initiative, Eurazeo contributes to integrating young people from underserved communities into employment; This foundation seeks to remove the social barriers these young talents may face and facilitate their access to the careers of their choice;

- ▰parenthood : Eurazeo proposes inclusive practices for maternity and co-parental leave:

- •in France: maternity leave of 45 days covered at 100% or 90 days covered at 50% of salary above the statutory period of leave. Co-parental leave allows fathers to take up to 2 additional weeks of leave on top of the statutory paternity leave,

- •abroad: maternity leave of 22 weeks covered at 100%, regardless of local regulations (unless they are more favorable),

- •in France, financing of nursery slots of up to 100%, set-up of a policy to grant leave when children are ill, or allocation of Universal Service Employment Vouchers (CESU) to receive aid to finance human services, and

- •flexibility, mainly through the implementation of a remote working charter.

Eurazeo goes beyond the issues of gender parity and social inclusion, by promoting employment for people with disabilities through various actions: during the recruitment process, considering all candidates with disabilities whose profile corresponds to the position sought, supporting employees who are officially recognized as having disabilities (RQTH(19)).

These actions are a testament to Eurazeo’s commitment to an inclusive and equitable culture, promoting diversity and professional development for all.

Eurazeo’s commitments are recognized by its industry. It ranks in the 1st quartile among 82 Private Equity companies in the following categories: representation of women in investment roles and junior investment roles, representation of women in investment leadership roles, representation of women in recruitment (McKinsey & Company’s State of Diversity in Global Private Markets report). Eurazeo is also ranked 2nd in the “Private Equity” category with a score of 85 among 301 companies in the Honordex Inclusive PE & VC Index 2024 report.

Top management as of December 31, 2024 by gender [S1-9]

Eurazeo

iMGP

Total

Unit

Workforce

%

Workforce

%

Workforce

%

Breakdown of top management (20) as of December 31 by gender

86

100%

16

100%

102

100%

Women

25

29%

3

19%

28

27%

Men

61

71%

13

81%

74

73%

Workforce as of December 31, 2024 by age [S1-9]

Incidents of discrimination and harassment [S1-17]

Eurazeo guarantees an adequate wage for all its employees in every region to cover their basic needs and those of their families.

In 1998, Eurazeo SE signed its first incentive agreement, a scheme which is optional to companies, and is renewed every 3 years. Eurazeo has also elected to use all the possibilities offered by the PACTE Law to benefit employees. A Group incentive agreement was set up in 2024 in France to enable employees to share in the Company’s success and solid performance.

Both in France and internationally, Eurazeo seeks to deploy benefits to its employees at the best market standards.

Gender pay gap [S1-16]

Eurazeo

iMGP

Total(21)

Gender pay gap as of December 31, 2024 (%)

41%

46%

42%

The gender pay gap is the average pay difference between male and female employees, expressed as a percentage of the average pay for men. The pay gap as of December 31, 2024 is calculated by taking into account the annual fixed salary, the target bonus and the free shares awarded in 2024. All permanent employees, functions, countries and grades are taken into account.

Annual total remuneration ratio [S1-16]

The total annual remuneration ratio compares the compensation of the highest paid individual with the annual median compensation of all employees (excluding the highest paid individual). The compensation used to calculate the ratio is the total of fixed and variable compensation awarded during the year and the valuation of options and shares granted during the year, as presented in Section 5.8.2 for corporate officers. The same compensation base is used for company employees. The scope used for the calculation of the annual remuneration ratio includes all permanent employees as of December 31, 2024, with the exception of those of Kurma Partners. Not yet wholly-owned, Kurma Partners retains its management autonomy and is not included in Eurazeo’s wage policy.

The Company ensures freedom of association, equal pay and respect for working hours and statutory holidays. Its practices promote diversity and prohibit harassment. Eurazeo has resolved to ensure the health, safety and well-being of its employees by respecting the laws in force and strictly preventing health and occupational risks. All employees must integrate the health and safety component in their conduct by respecting the guidelines and notifying any risk identified.

The nature of Eurazeo’s business greatly limits the risk of serious accidents occurring in the workplace. In France, occupational health-safety risk is assessed annually in the Single Risk Assessment Document in which no “high” level risks have been identified.

Eurazeo ensures the well-being of its employees by fitting out its premises, providing a workspace satisfying quality, hygiene and security standards, building adapted wellness areas and measuring psychosocial risks. In November 2024, the Company moved all the Parisian teams to the same address in a new first-rate secure environment.

Eurazeo strives to create a stimulating, collaborative and inclusive working environment that boosts performance and talent development. Mindful of the well-being of its employees, Eurazeo proposes schemes to promote their professional and personal development:

- ▰remote working charter created in 2019 and adapted in 2021. Employees therefore have a flexible work organization in France and abroad;

- ▰leave offered to interns in France and abroad;

- ▰new collaborative working methods: shared offices to encourage knowledge sharing between young and experienced employees and enabling project-based work;

- ▰dedicated areas for discussions, creativity, relaxation and well-being;

- ▰ergonomic and adaptable desks and provision of efficient and adapted IT tools;

- ▰spacious, modern and eco-responsible premises;

- ▰promotion of sports among its employees;

- ▰internal events to promote close bonds between all employees;

- ▰webinars to raise awareness on health and well-being at work (e.g.: naturopathy); and

- ▰family-related leave granted to all employees.

In 2024, absenteeism rate(24) was 3%.

Percentage of permanent employees as of December 31, 2024 who took family-related leave [S1-15] (25)

Eurazeo

iMGP

Total(26)

Percentage of permanent employees who took family-related leave

8%

5%

8%

Women

8%

7%

8%

Men

9%

3%

8%

In general, Eurazeo has first-rate premises that comply with local standards and are based in locations that ensure a safe working environment that is well integrated into the urban context.

In 2024, to comply with safety requirements in France, Eurazeo conducted fire drill training for volunteer employees at its new head office premises. Eurazeo will continue its actions to train its employees in regulatory programs: occupational first aid, workplace fire safety.

The impact of psychosocial risks on the Company and employees was judged to be low. Two components were considered to carry a moderate risk: work intensity and working time. These issues are regularly covered in awareness-raising sessions. SEC members in France have been trained in psychosocial risks at work. This training was renewed in May 2024 following the professional elections of the new EGI SEC.

3.3.1.6Targets related to managing material negative impacts, advancing positive impacts, and managing material risks and opportunities [S1-5]

Diversity

In addition to its achievements, Eurazeo has defined goals to increase the number of women on its teams: for the overall workforce, with a focus on investment teams, for annual hirings and a willingness to limit the gender pay gap, taking into account professions, grades. Maintaining a representation greater than or equal to 40% for the least represented gender on the Supervisory Board is also an objective. The composition of the Supervisory Board is summarized in Section 3.1.2.1, and detailed in Chapter 5. Finally, for France, Eurazeo also aims to maintain a Gender Equality Index (Pénicaud-Schiappa) greater than or equal to 85/100.

Employee engagement

Eurazeo aims to maintain the People Survey engagement rate above 70%, with a participation rate also above 70%. The 2024 People Survey engagement rate was high (77%).

iM Global Partner