URD 2023

-

Activity

during the year

and outlook2.1Activity during the year

2.1.1Highlights

The highlights mentioned below are a selection of the events and transactions that took place during the year for the Group and each of the strategies.

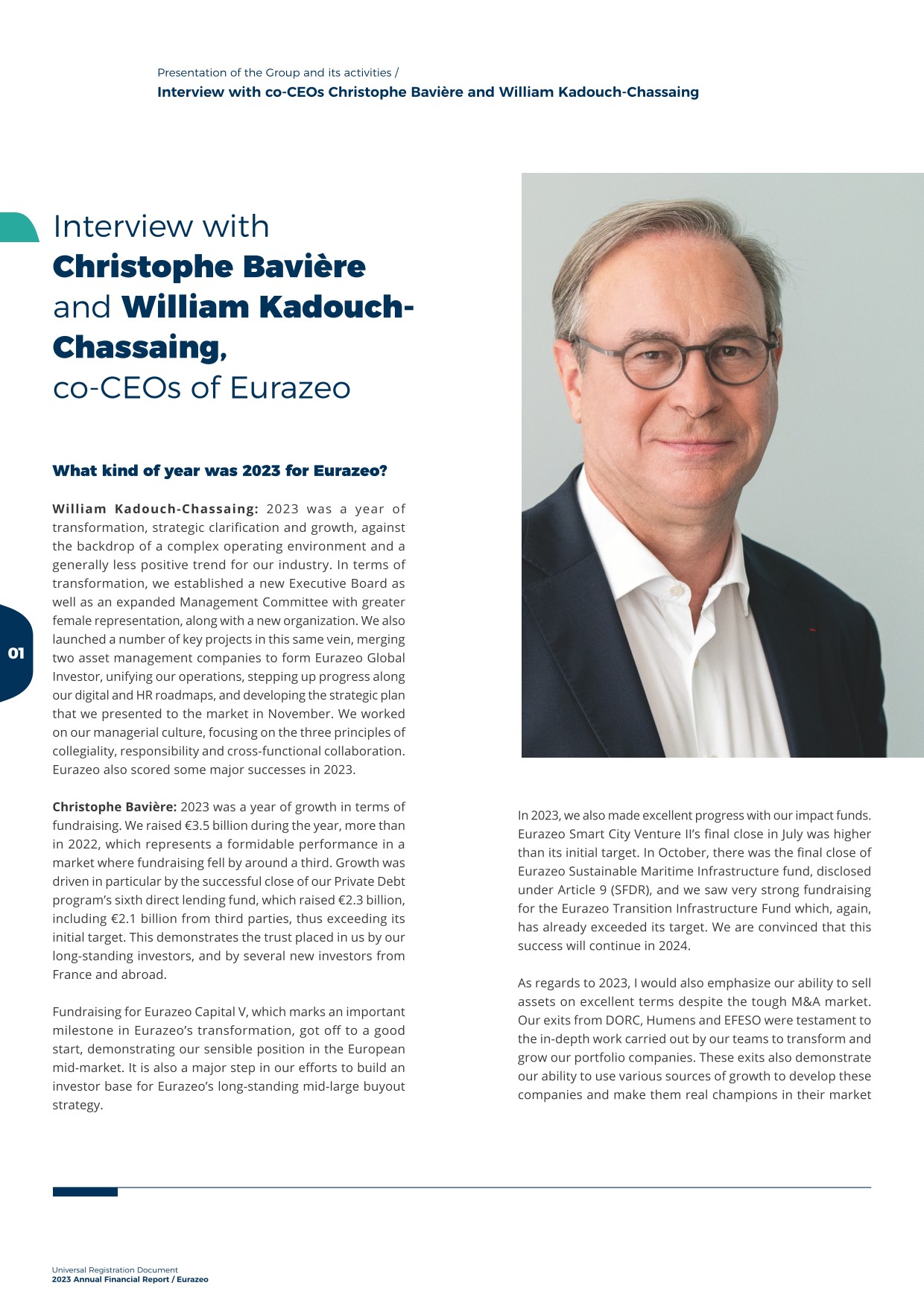

Corporate

- ANomination of a new Executive Board, composed of two Co-Chief Executive Officers: Christophe Bavière and William Kadouch-Chassaing as well as Sophie Flak, Managing Partner - ESG and Digital and Olivier Millet, Managing Partner – Small-mid buyout & NovSanté. This new Executive Board, appointed unanimously by the Supervisory Board, has been given the mission to accelerate Eurazeo’s development towards third-party asset management, optimize the capital allocation and continue to improve the Company’s financial and non-financial performance for the benefit of its clients and shareholders;

- ASet-up of a Management Committee with 23 members. It is responsible for defining, implementing and monitoring Eurazeo’s strategic directions. As such, it ensures the execution of the strategy of diversifying our investment sectors and asset classes, international deployment, fundraising, analysis of our market environments and our external growth operations;

- AOn November 30, 2023, Eurazeo held a Capital Markets Day to inform the market of its strategic plan and ambitions for 2027: become the leading private asset manager in Europe across mid-market, growth & impact segments;

- AFor the second year in a row, Eurazeo won the Best Overall Fundraising: Secondary category award in the Private Equity Wire European Awards 2023;

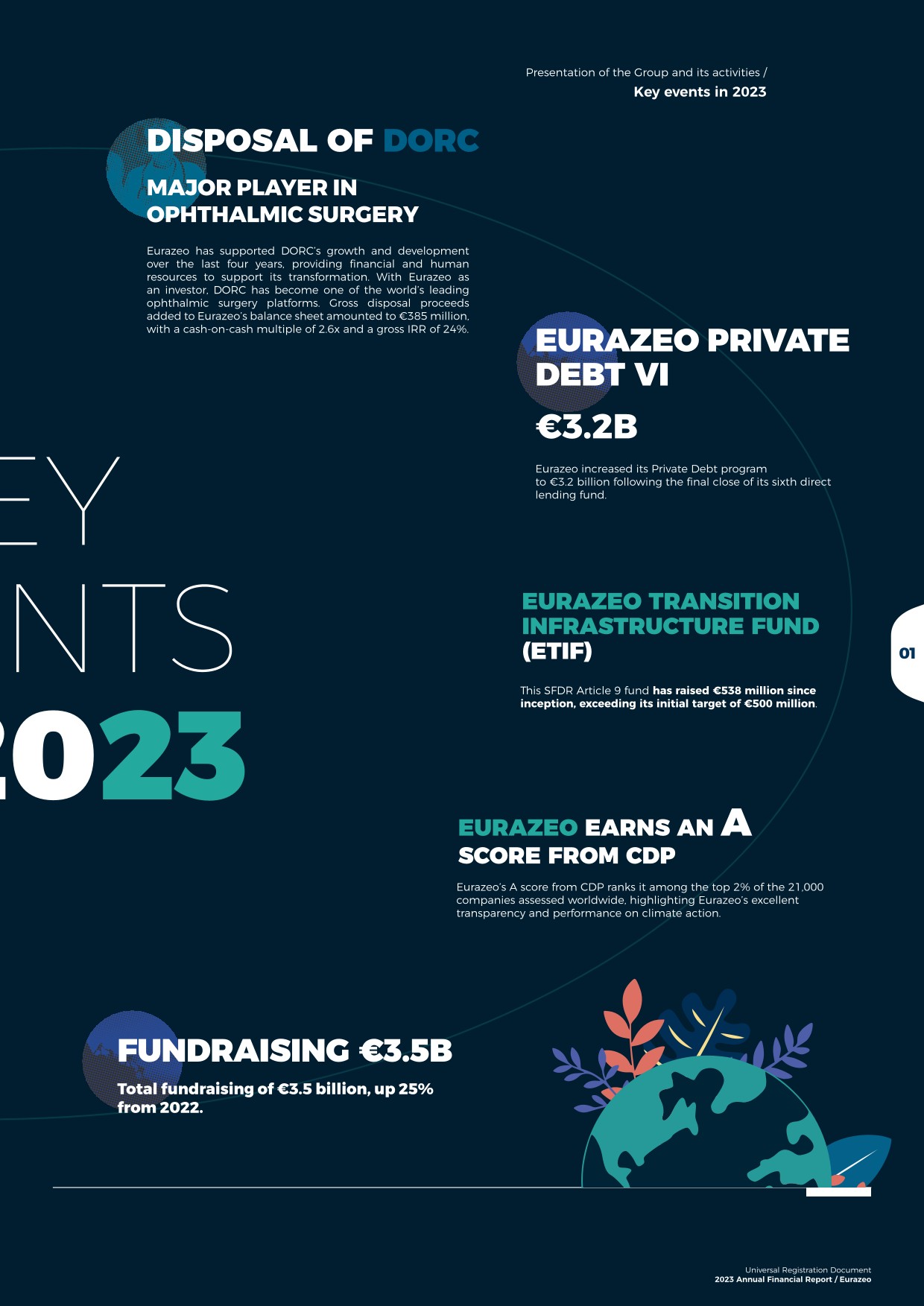

- AEurazeo obtained the A score from the Carbon Disclosure Project (CDP), underlining its unwavering commitment to environmental transparency and combating climate change;

- AFundraising totaled €3.5 billion, up 21% compared to 2022;

- AThe Wealth Management team signed two new partnerships with Moonfare and iCapital to make Eurazeo’s investment solutions more accessible to private clients in Europe, particularly Germany, Benelux, Italy and Switzerland.

Private equity

BUYOUT

Mid-large

- AEurazeo has completed a £355 million investment in BMS Group, a leading independent (re)insurance broker based in London (34% of its share capital). Eurazeo and its affiliates joined BMS alongside its existing shareholders British Columbia Investment Management Corporation (BCI), Preservation Capital Partners (PCP) and BMS’ management and employees;

- ASuccessful fundraising by Eurazeo Capital V, with an initial close at €2.3 billion, including around €600 million from third parties. This initial fundraising by Eurazeo Capital V is an important milestone in the Group’s shift towards managing assets for third parties;

- AEurazeo and its affiliates announced the sale of their investment in DORC (Dutch Ophthalmic Research Center) to Carl Zeiss Meditec AG for an enterprise value of approximately €1 billion. Eurazeo has supported the company as a majority shareholder since 2019;

- AEurazeo and its partners Ardian, Mérieux Equity Partners and Eximium sold their investments in the Humens group to Leto Partners. The capital invested has generated a gross cash-on-cash multiple of 2.7x and an internal rate of return (IRR) of 65% since the Seqens group’s carve-out in December 2021.

Small-mid

- AEurazeo sold Vitaprotech, the French leader in premium security solutions for sensitive sites. The transaction generated an initial investment multiple of 3.3x and an internal rate of return (IRR) of 32%, i.e. total divestment proceeds of €139 million for the funds managed by Eurazeo received in January 2023. Supported since July 2018 by Eurazeo, the Group tripled in size in 4 years with strong organic growth;

- AEurazeo completed a partial exit from Groupe Premium following an equity contribution of €400 million from Blackstone to support the company’s strong growth. The transaction valued the company at €1.15 billion. The funds managed by Eurazeo realized a cash-on-cash multiple of 3.3x, i.e. around €320 million, of which €135 million was reinvested in the operation to support the Group’s steady growth;

- AEurazeo completed a sale and reinvestment in EFESO Management Consultants through its successor fund, as part of a co-control framework with TowerBrook Capital Partners and the management team. Since 2019, Eurazeo has been the majority shareholder of EFESO, a leading international consulting pure player in operations strategy and performance improvement. This transaction generated divestment proceeds of €164 million for Eurazeo, representing a multiple of 3.0x. As part of the reinvestment, the Eurazeo managed funds invested a total of €113 million.

VENTURE

- AThe Venture team participated in the series B fundraising of Exotrail, a space mobility operator based in France which proposes products focusing on satellite mobility, optimizing their deployment, increasing their service performance, and reducing space pollution;

- AThe Venture team participated in the US$20 million financing of the startup Cado specializing in cybersecurity, and based in the UK, to further its global expansion and drive the company’s innovation;

- AEurazeo completed the final closing of its smart city and climate investment program at €400 million, exceeding the initial target. Altogether five sovereign wealth funds and development institutions, EIF, Bpifrance, PFR, F.R.C and KVIC, joined by 18 corporations in Europe and Asia, support the new fund.

GROWTH EQUITY

- AIn July 2023, Ms. Hala Fadel was appointed as Managing Partner in charge of Eurazeo’s Growth strategy. In this role, she joins Eurazeo’s Management Committee;

- AThe Eurazeo Growth team was strengthened with the arrival of Raluca Ragab as Managing Director and Head of the Growth activity in the UK;

- AEurazeo was lead investor in the US$210 million Series D financing round of Aiven, a software developer combining the best open source technologies and a cloud infrastructure. The start-up seeks to provide public access to data technologies, reduce the environmental impact of cloud services and boost diversity and inclusion within the company and in the technologies sector;

- AEurazeo invested in Commercetools, a digital platform enabling retailers, brands and manufacturers to produce their own business solutions (e-commerce and omnichannel).

Secondaries

- AThe Private Funds Group team won the Best French LP: Regional Strategy award at the Private Equity Exchange & Awards organized by Décideurs Corporate Finance. This rewards the track record of our European funds spanning over 20 years, making Eurazeo one of the top private fund investors in Europe.

Private debt

- AEurazeo announced the successful closing of its sixth direct lending fund at €2.3 billion, including €2.1 billion from third parties, thereby exceeding the initial target of €2 billion. Adding in the €900 million raised from retail investors, the total scale of Eurazeo’s Private Debt program reaches €3.2 billion;

- AEurazeo, via its Corporate Financing business and its Eurazeo Corporate Relance (ECR) fund, invested in Patriarche, a multi-discipline architecture group founded in 1960 and ranked among France’s top five architecture firms. Eurazeo Corporate Relance (ECR) is an investment fund focused on successful, robust, family-owned small and medium-sized businesses;

- AEurazeo is supporting the acquisition of Italian project management business EXA Group by Montefiore Investments;

- AThrough its Corporate Financing business and its Eurazeo Corporate Relance (ECR) and NOVI 2 funds, Eurazeo became a new investor alongside Trocadero Capital Partners and Bpifrance in Eowin;

- AEurazeo’s Private Debt team financed the acquisition of Inke by Keensight Capital through a unitranche credit facility. The transaction is the 8th sponsor-led financing arranged in the Iberian Peninsula;

- AEurazeo invested in CTN Groupe via its Corporate Financing business and its Eurazeo Corporate Relance (ECR) and NOVI 2 funds;

- AEurazeo, via its Insurtech fund backed by the insurer BNP Paribas Cardif, invested in Igloo’s US$36 million Pre-Series C funding round in Singapore, with participation from Openspace and La Maison;

- AEurazeo completed a 5th transaction totaling €22.5 million for the Eurazeo Sustainable Maritime Infrastructure (ESMI) fund. This investment consists in the financing of the first next-generation zero-emission short sea container vessel, being launched by the Samskip Group.

Real assets

Infrastructure

- AEurazeo, via its Eurazeo Transition Infrastructure Fund, invested in regional data center provider Etix Everywhere to support its carbon emission reduction trajectory. The latter, specializing in local colocation services, is pursuing its sustainable expansion with strategic acquisitions such as CIV France;

- AEurazeo Transition Infrastructure Fund (ETIF) completed a second closing, bringing total commitments to around €420 million, i.e. around 80% of its initial target size, only 3.5 months after its first closing. This closing sees further diversification of the investor base, which includes global institutional investors and capital from both dedicated infrastructure allocations and SFDR Article 9 funds;

- AEurazeo, via its Transition Infrastructure Fund, invested in TSE. Bpifrance and investors from the Crédit Agricole group also took part in this €130 million fundraising round;

- AEurazeo invested in 2BSI via its Transition Infrastructure Fund and will support the group in its decarbonization strategy. Through this transaction, Eurazeo becomes the majority shareholder in 2BSI, alongside its historical investors and the management team.

Real estate

- AEurazeo’s Real Estate team let 100% of space in the Highlight campus to Grape Hospitality, Compagnie des Fromages, RichesMonts, CBRE GWS and Comexposium. This modern 24,000 m2 campus in Courbevoie overlooking the Seine river already houses the headquarters of Kaufmann & Broad and the Seine-Normandie water agency (AESN).

-

2.2Value creation

Investment portfolio net value, value creation and assets under management

Strong increase in portfolio value per share and stable value creation

Portfolio value per share

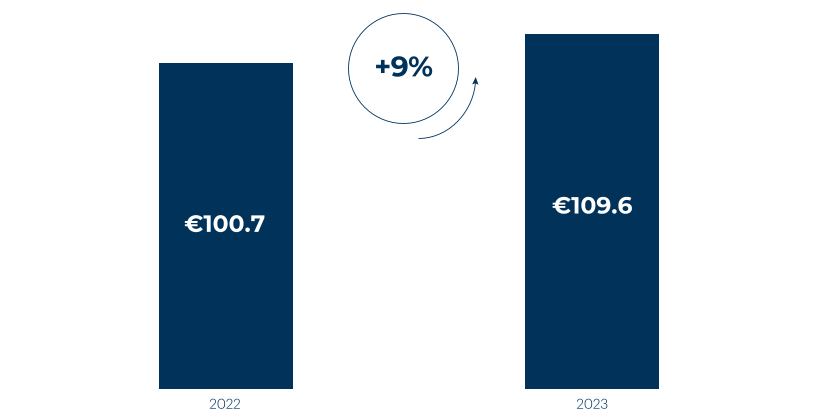

At the end of 2023, the net value of the investment portfolio was €8,319 million, up +6%. Taking into account the +3% positive effect of share buybacks, the portfolio value per share rose +9% to €109.6.

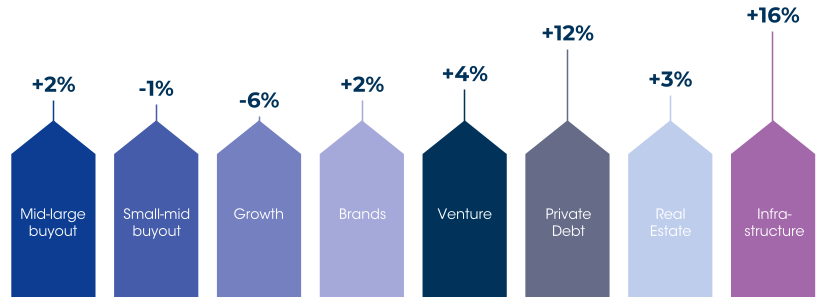

Portfolio value creation by investment division

Most divisions contributed to investment portfolio net value growth in 2023, with portfolio value creation of 1%:

Assets Under Management

(In millions of euros)

12/31/2022 – Pro forma Rhône

12/31/2023

Third-party AUM

Eurazeo balance sheet AUM

Total AUM

Third-party AUM

Eurazeo balance sheet AUM

Total AUM

Private Equity

13,841

8,706

22,547

15,530

8,965

24,495

Mid-large buyout

2,165

4,723

6,888

3,085

4,747

7,833

Small-mid buyout

1,537

1,103

2,641

1,467

997

2,463

Growth

2,566

1,940

4,506

2,527

2,037

4,564

Brands

-

739

739

-

781

781

Healthcare (Nov Santé)

418

-

418

418

-

418

Venture

3,270

117

3,387

3,129

129

3,258

Private Funds Group

3,886

83

3,969

4,904

274

5,179

Private Debt

6,604

262

6,865

7,117

363

7,479

Real Assets

472

1,142

1,614

771

1,169

1,939

MCH PE (25%)

325

88

413

360

97

457

Kurma

436

49

485

457

53

510

Other

-

69

69

-

73

73

Total

21,677

10,316

31,993

24,234

10,718

34,952

-

2.3Subsequent events

On January 15, 2024, Eurazeo Group, via its Eurazeo Transition Infrastructure Fund, announced its renewed support in Electra, after having become a cornerstone investor in June 2022 as part of a fundraising round of €304 million.

On January 18, 2024, Eurazeo, via its Nov Santé Actions Non Cotées fund, announced the finalization of its first investment in Kinvent, acquiring a minority stake as part of its €16 million fundraising.

On January 18, 2024, Eurazeo announced that it had acquired a minority stake of around €25 million in Ex Nihilo as part of a minority investment.

On January 23, 2024, Eurazeo, via its Nov Santé Actions Non Cotées fund, announced that it had acquired a minority stake of €22 million in the Oncodesign Services group as part of the acquisition of ZoBio.

-

2.4Outlook

The Group presented its growth outlook at a Capital Markets Day on November 30, 2023, and its medium-term ambition to become the leading private asset manager in Europe in the mid-market, growth and impact segments. The strategic objectives and financial outlook for the period 2024-2027 presented at this event are confirmed.

-

Eurazeo Corporate Social Responsibility

3.1Sustainability strategy

3.1.1O+: Powering a fair and just transition

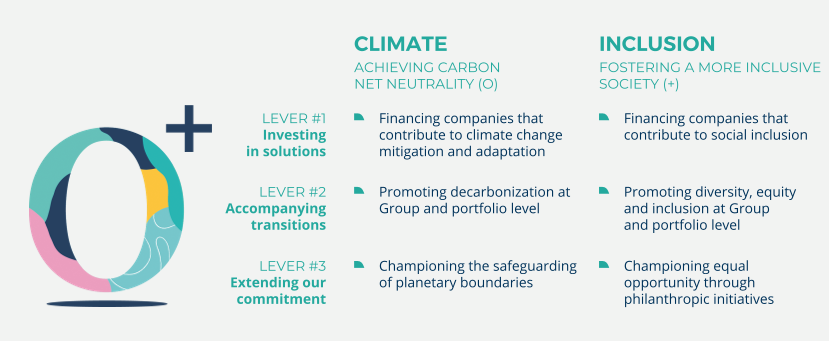

Managing environmental, social and governance (ESG) considerations and integrating them at the core of the business model is imperative to ensure resilience and long-term performance. They represent a fundamental aspect, fully integrated into Eurazeo’s strategic and operational decisions, just as financial aspects. This is a key differentiating factor, both for investors who entrust us with their capital and for companies that entrust us with their growth.

Taking these issues into account allows to anticipate risks (fiduciary, regulatory and reputation) and market trends, identify future-proof companies and help them adapt their business models to a low-carbon and more inclusive economy. This results in a portfolio that is both resilient and performing. This has been Eurazeo’s conviction for nearly 20 years, making the Group a pioneer and a recognized leader in responsible investment.

The Group’s sustainability strategy, named O+, is structured around two flagship commitments: achieving carbon net neutrality (O) and fostering a more inclusive society (+). It applies to the Group and all portfolio companies. By integrating the environmental and social dimensions in a balanced and cohesive manner, O+ enables Eurazeo to be a driving force towards a just transition. How does this translate in practice?

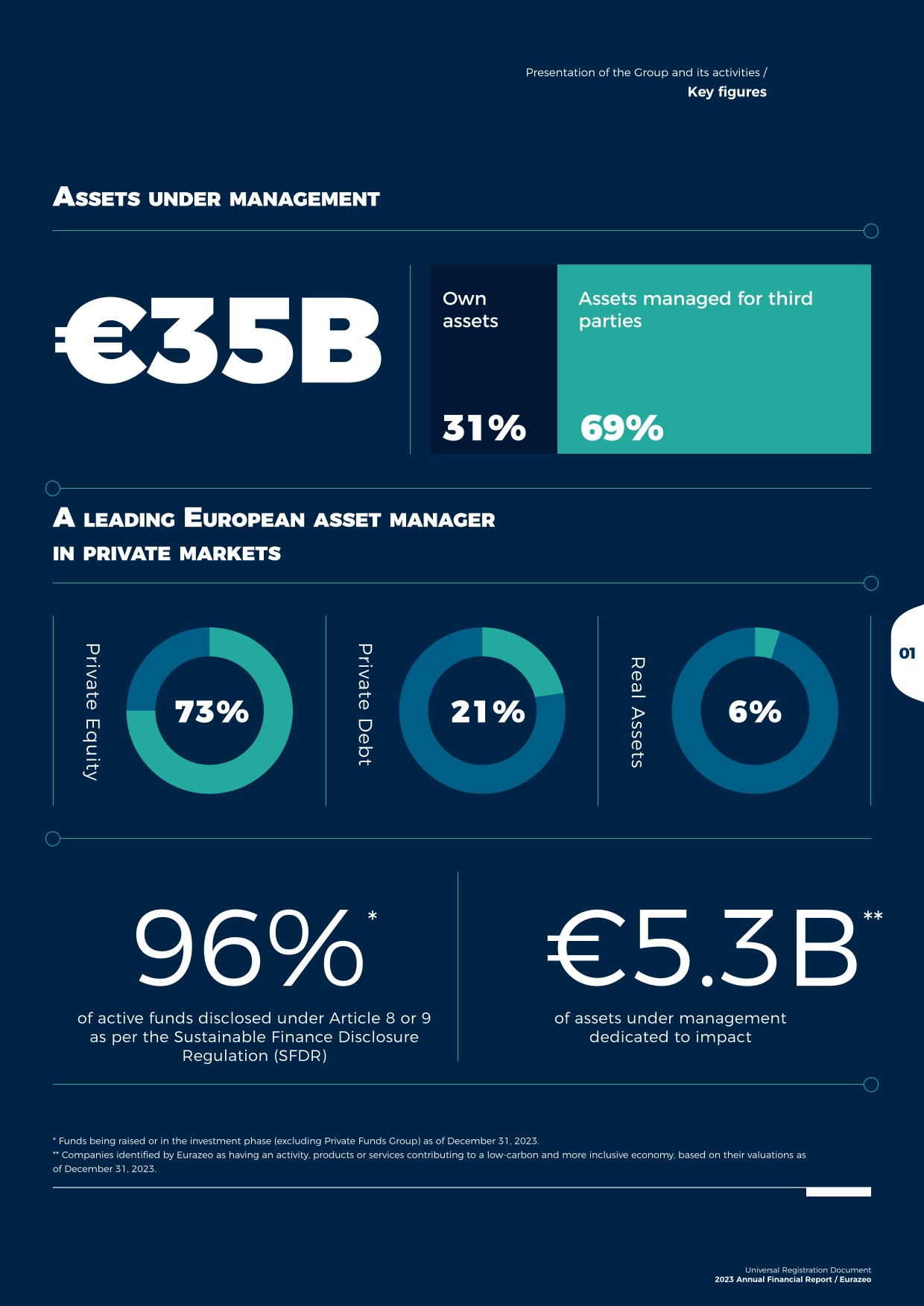

- AMobilizing capital towards the development of solutions: Eurazeo finances companies that contribute, through their activities, products or services, to climate change mitigation and adaptation, as well as to improving social inclusion. At the end of 2023, they represented €5.3 million of assets under management, up 23% compared to the end of 2022. In recent years, the Group has accelerated these investments, mainly by creating return-first impact funds, with profitability profiles aligned with the best standards in their asset classes. Eurazeo aims to broaden its offer, convinced that impact is a source of resilience, growth and performance, and presents a significant opportunity to develop its assets under management.

- AReducing environmental impact to the fullest: Eurazeo was the first Private Equity firm in Europe to commit to a scientific decarbonization pathway with the Science Based Targets initiative (SBTi). The Group launched a program for portfolio companies, designed to train them on decarbonization and give them access to carbon experts to develop and implement their climate strategy. Beyond climate issues, Eurazeo is committed to aligning its activities with all planetary boundaries, including those related to biodiversity and water.

- AMaximizing social impact and strengthening societal contribution: Eurazeo has a solid culture of diversity, equity and inclusion (DEI). In addition to having set ambitious goals for gender parity within its teams for 2030, the Group actively participates in initiatives aimed at promoting DEI best practices. It also encourages its portfolio companies to adopt fairer and more inclusive practices. Beyond its frontiers, Eurazeo leans into philanthropic projects that foster youth protection and education.

- AMeeting the highest sustainability standards: Eurazeo is regularly recognized for its commitment and steady progress in ESG and impact . The Group leverages globally renowned frameworks and initiatives to shape and implement its O+ strategy and adopts a continuous improvement approach to its processes. Over the years, the Group has established best-in-class practices such as the integration of sustainability objectives into executive compensation and the implementation of an engagement program to raise awareness, train and engage its stakeholders in ESG issues.

-

3.2Non-Financial Performance Statement

- →Details relating to this section

Eurazeo has no legal obligation to publish a NPFS in accordance with Articles L. 225-102-1, R. 225-105 and R. 225-105-1 of the French Commercial Code. Nevertheless, it decided to prepare an NPFS voluntarily in accordance with the aforementioned texts and publish it in Section 3.2 of the Universal Registration Document. The NPFS covers the investment company Eurazeo SE together with its regulated affiliates. For the third consecutive year, the NFPS focuses on Eurazeo’s investor business. A comprehensive methodology is available in Section 3.4 Methodology.

3.2.1Summary table of risks and opportunities

Eurazeo may be concerned by risks that could affect its investment activity. An internal control and risk management system has been established. It is led by a dedicated department under the supervision of the Executive Board, and serves to identify, prevent and limit the impact of these key risks. ESG is an integral part of the risk assessments conducted.

In 2021, the Eurazeo group refocused its non-financial risk analysis on its investor and asset management activity. This renewed approach was driven by several factors:

- Athe business model’s development towards third-party asset management which represents 69% of assets under management as of December 31, 2023. The Eurazeo business model is presented in Section 1;

- Agrowth in the teams of the investment company Eurazeo SE, the management companies that it controls and its foreign offices;

- Athe desire to strengthen specific presentation, success and progress of third-party asset management, which includes ESG at every stage, from fundraising to investment.

This refocusing also provided an opportunity to clarify the structure of the Group’s ESG publications which are complementary:

- Athis NFPS, refocused around Eurazeo’s activity as an investor and asset manager;

- Athe O+ progress report, published in the second quarter of 2024, which presents ESG progress for assets under management.

On January 1, 2023, Eurazeo determined that it now satisfies the criteria of an Investment Entity as defined in IFRS 10, Consolidated financial statements. This standard provides an exemption whereby Investment Entities need not present consolidated financial statements (see Section 6.1.6 Notes to the consolidated financial statements, Note 1.1 Preamble – Investment company status).

- Athe sharply dwindling proportion of controlled and consolidated companies in the managed assets, considering the increasing weight of new strategies often invested in minority stakes; accordingly, the ESG issues creating risks and opportunities for controlled companies are too limited to be representative of the entire investor activity of Eurazeo and its portfolio;

- Afor controlled companies, the growing proportion of entities in the portfolio that are smaller than the previously held assets and the lack of companies exceeding the NPFS thresholds within this scope;

- Athe movements (portfolio entries and exits) which make the ESG data for the scope of controlled companies incomparable from one year to the next.

- AEurazeo SE, the investment company listed on Euronext Paris;

- AEurazeo Funds Management Luxembourg, an AIFM portfolio management company certified by the Commission de Surveillance du Secteur Financier, the Luxembourg financial services regulator, under registration number A00002174;

- AEurazeo North America, an asset manager governed by US law, which obtained the status of US Investment Advisor with the Securities and Exchange Commission on June 28, 2019;

- AEurazeo UK Limited, a subsidiary of Eurazeo SE governed by UK law, certified by the Financial Conduct Authority (FCA), the UK financial services regulator, since May 23, 2022;

- AEurazeo Infrastructure Partners, a portfolio management company certified by the AMF as an alternative investment fund manager (AIFM) within the meaning of Directive EU/2011/61, under the registration number GP202173;

- AKurma Partners, a portfolio management company certified by the French Financial Markets Authority (AMF) as an alternative investment fund manager (AIFM) within the meaning of Directive EU/2011/61, under the registration number GP-09000027;

- AEurazeo Global Investor, a portfolio management company certified by the AMF as an alternative investment fund manager (AIFM) within the meaning of Directive EU/2011/61, under the registration number GP97-117 (33).

-

3.3Key Performance Indicators Table

2023

2022 (2)

2021 (1)

Consideration of ESG impacts and dependencies in the investment process

Percentage of acquisitions aligned with the exclusion policy

100%

100%

100%

Percentage of acquisitions subject to ESG due diligence

100%

100%

100%

Percentage of investments that responded to ESG reporting

78%

71%

69%

Regulatory developments

Percentage of Article 8 and 9 classified funds

96%

90%

83%

Percentage of Article 9 funds whose sustainability indicators have been verified by an independent third-party

100%

100%

100%

Quality of ESG data

Percentage of ESG indicators calculated based on real data

98%

97%

-

Inclusion of ESG at every stage of the client relationship

Number of ESG meetings organized with investors

69

44

-

Number of ESG questionnaires received during the year

247

-

-

Working conditions and freedom of association

Total number and breakdown of employees

Total workforce

441

431

347

Permanent workforce

425

421

338

Percentage of women in the permanent workforce

45%

47%

43%

Percentage of managers in the permanent workforce

98%

99%

85%

Percentage of non-permanent workforce in relation to the total number of employees

4%

2%

3%

Geographic breakdown

France

81%

82%

82%

Europe excluding France

11%

10%

10%

USA

5%

5%

6%

Other regions

3%

3%

2%

Working hours (% of permanent workforce)

Percentage of full-time employees

99%

97%

99%

Percentage of part-time employees

1%

3%

1%

Health and safety conditions (permanent and non-permanent workforce)

Absenteeism rate

0.9%

1.3%

0.8%

Health insurance cover (permanent employees)

Percentage of employees with health insurance

100%

100%

100%

Percentage of employees with personal accident insurance

100%

100%

100%

Equal treatment

Gender diversity (permanent workforce)

Percentage of women

45%

47%

44%

Percentage of female managers

47%

47%

43%

Percentage of women on the SB or BD

44%

42%

42%

Percentage of women in the primary management body

25%

17%

17%

Average salary gap M/F

35%

26%

Attractivity and employability

Hires and departures (permanent workforce, number of employees)

Hires

56

102

88

Departures

52

38

32

Compensation and benefits (permanent workforce, in millions of euros)

Total payroll

107

93

63

Amount of mandatory collective bonus or profit-sharing schemes

4.9

4

3

Amount of incentive or collective bonus schemes outside legal obligations

3.9

3

2

Percentage of employees benefiting from a value creation sharing scheme (4)

90%

97%

82%

Training (permanent and non-permanent workforce)

Total number of training hours

3,791

3,136

2,823

Percentage of employees who attended at least one training course during the year

99%

76%

84%

Ethics

Percentage of new employees who signed the Code of Conduct during onboarding

96%

82%

100%

Taxation

Reporting to the Executive Board on changes in tax risks

7

6

-

2023 (3)

2022 (2)

2021 (1)

Climate change

Energy consumption excluding fuel (in MWh)

Electricity

44

28

540

Renewable energies

1,018

961

531

Natural gas

160

165

30

Total energy consumption

1,222

1,153

1,101

Share of renewable energies

83%

83%

48%

Fuel consumption (in liters)

Gasoline

6,915

14,129

6,130

Diesel

3,651

2,355

5,387

Total fuel consumption

10,567

16,484

11,517

GHG emissions (in metric tons of CO2 equivalent)

Scope 1

51

65

34

Scope 2 – market-based

21

14

146

Scope 2 – location-based

143

104

174

Total (Scopes 1 + 2)

71

79

180

Scope 3

8,182

13,283

11,797

Total (scopes 1 + 2 + 3) (5)

8,254

13,362

11,977

- ( 1 )2021: the indicators cover the activities of Eurazeo SE and its offices in Paris, London and Shanghai, Eurazeo Mid Cap (EMC), Eurazeo Investment Manager (EIM) and its offices in Paris, Berlin, Frankfurt, Madrid, Seoul and Singapore, Eurazeo Funds Management Luxembourg (EFML) and Eurazeo North America.

- ( 2 )2022: the indicators cover the activities of Eurazeo SE and its offices in Paris, London and Shanghai, Eurazeo Mid Cap (EMC), Eurazeo Investment Manager (EIM) and its offices in Paris, Berlin, Frankfurt, Madrid, Seoul and Singapore, Eurazeo Funds Management Luxembourg (EFML), Eurazeo North America and Kurma.

- ( 3 )2023: the indicators cover the activities of Eurazeo SE and its offices in Paris, Eurazeo Global Investor (EGI) and its offices in Paris, Berlin, Frankfurt, Madrid, Milan, São Paulo, Seoul and Singapore, Eurazeo Funds Management Luxembourg (EFML), Eurazeo North America, Eurazeo UK, Eurazeo China and Kurma.

- ( 4 )Employees who have left the company are not included in the total number of employees concerned

- ( 5 )Eurazeo’s calculated scope 3 emissions relate to purchased goods and services, IT capital goods, business travel and fuel- and energy-related activities (not included in scope 1 or scope 2). Note: following an improvement in methodology in 2023 and in accordance with the Group’s accounting scope, Eurazeo changed the allocation of emissions relating to deal fees, which were added to category 15 “investments” for the relevant companies. In 2022, they accounted for 6,964 tCO‹#INDICE|2|INDICE#›eq., included in Scope 3.2.

-

3.5Independent Third Party Report

Report by one of the Statutory Auditors on the consolidated non-financial information statement

This is a free translation into English of the Statutory Auditor’s report issued in French and is provided solely for the convenience of English speaking readers. This report should be read in conjunction with, and construed in accordance with, French law and professional standards applicable in France.

In our capacity as Statutory Auditor of Eurazeo (hereinafter the “entity”), as requested, we hereby report to you on the consolidated non-financial performance statement for the year ended December 31, 2023 (hereinafter the “Statement”), included in the 2023 Universal Registration Document, prepared pursuant, on a voluntary basis, to the legal and regulatory provisions of Articles L. 225-102-1, R. 225-105 and R. 225-105-1 of the French Commercial Code (Code de commerce).

-

3.6Vigilance Plan

3.6.1Introduction

Pursuant to Article L. 225-102-4 of the French Commercial Code, Eurazeo’s Vigilance Plan aims to cover reasonable vigilance measures to identify risks and prevent serious harm to human rights and fundamental freedoms, personal health and safety and the environment, resulting from Eurazeo activities and the activities of companies which it controls directly or indirectly, as well as the activities of subcontractors or suppliers with which it has an established business relationship, when these activities are linked to this relationship.

This vigilance approach is aligned with the Eurazeo’s ESG strategy described in this document in Section 3.1 as well as on the Eurazeo’s website in the Responsibility and Impact section. This Section 3.6 aims to only cover the specific provisions relating to the Duty of Vigilance Law.

Actions to encourage best practices to prevent risks of serious harm to human rights, fundamental freedoms, personal health and safety and the environment in this Vigilance Plan are reasonable due diligence actions which should be implemented by Eurazeo, Eurazeo’s suppliers, companies controlled by Eurazeo and their own suppliers. It is recalled that the companies controlled by Eurazeo are extremely varied in nature. Accordingly, the Vigilance Plan cannot be applied uniformly across the entire scope or be considered to cover all the risks of each entity; each company must therefore initiate and adapt this plan to reflect its effective risks.

-

Risk

factorsEurazeo is a leading European investment group in asset management for institutional and private clients. Its mission, as a private markets investment group, is to maximize value creation responsibly and over the long-term, for its clients and shareholders. Its proven investment experience and its platform operating across all asset classes (mainly in Europe) enable the Eurazeo group to create value by supporting companies in their development and then pass this value on to clients when realizing these investments. One of the features of its business model is that it calls on its balance sheet, by investing its equity (i) alongside its clients in its different asset classes/strategies (thereby ensuring optimal alignment of interests), and (ii) to develop competitive advantages that accelerate growth (e.g. seeding new strategies, deal warehousing, etc.).

In 2023, Eurazeo launched a new phase in its development and the scaling-up of its model, with the ambition to become, by 2027, the European leader in private asset management in the mid-market, growth and impact segment. To this end, Eurazeo defines and pursues a certain number of strategic, financial and operating objectives. The occurrence of certain risks could impact its ability to achieve its objectives. In the same way as other companies, Eurazeo operates in an environment subject to uncertainty, where risk-taking is inseparable from the search for opportunities and the desire to grow the Company.

It is therefore important for Eurazeo to identify, prevent and mitigate the impact of the main risks likely to threaten the attainment of its objectives, by designing and implementing appropriate internal control and risk management systems. Under the responsibility of the Executive Board, these systems:

- Aare incorporated into the business model and business processes specific to the organization, in order to contribute positively to the conduct and management of its different activities and provide a competitive edge for the Company, particularly by improving decision-making; and

- Aare part of a continuous improvement process, mobilizing Company employees around a shared vision of the main risks.

While being as well implemented and designed as possible, the internal control and risk management systems cannot provide an absolute guarantee that the Company’s objectives will be achieved. The systems are generally limited by human factors: decision-making relies on people and the exercise of their judgment.

- ( i )the characteristics of the internal control and risk management systems implemented byEurazeo; and

- ( ii )the specific aspects of the main risks to which the Group is exposed.

- Athe information presented does not claim to be comprehensive (unknown risks, risks poorly or not identified, etc.) and does not cover all the risks to which the Company may be exposed in the conduct of its activities. The analysis performed by Eurazeo focuses on those risks considered capable of calling into question business continuity or that could have a material negative impact on its activity, financial position or results (financial impact, particularly on management fees, performance fees or the net value of Eurazeo’s portfolio) and/or on the development of the Company (particularly impacting its reputation and the human factor). To the best of Eurazeo’s knowledge, there are no material risks other than those presented. Information on financial risks is also presented pursuant to the French Commercial Code (Article L. 22-10-35);

- Athe description only provides an overview of risks at a point in time;

- AEurazeo’s legitimate concerns regarding the possible consequence of disclosing certain information have been taken into account, while respecting the rules governing the communication of information to the market and investors.

4.1Risk management and internal control systems

The risk management and internal control systems provide a complementary contribution to controlling the activities of the Company:

- Athe risk management system seeks to identify and analyze the main risks to which the Company is exposed. Identified risks likely to exceed the acceptable limits set by the Company are mitigated and, when required, action plans are prepared. These actions plans provide for the implementation of controls, the transfer of the financial consequences (insurance mechanisms or equivalent) or a change to the organizational structure;

- Athe internal control system relies on the risk management system to identify the main risks to be controlled. In the same way as the general principles of the AMF framework, Eurazeo’s internal control system seeks to ensure: compliance with legislation and regulations, application of the instructions and strategic direction set by the Executive Board, the smooth running of the Company’s internal processes, particularly those contributing to the security of its assets and the reliability of financial information.

These systems rely on processes (4.1.2), key players (4.1.3) and an environment promoting honest and ethical behavior (4.1.4), which are presented successively below.

The systems presented (functioning as of December 31, 2023) cover all transactions performed within a scope comprising the investment company Eurazeo SE, the portfolio management companies (located in Paris and Luxembourg) housing the various investment strategies, as well as the directly controlled investment vehicles and the offices (subsidiaries, branches and representation offices) located outside France (New York, London, Frankfurt, Berlin, Milan, Madrid, Shanghai, Seoul, Singapore and São Paulo).

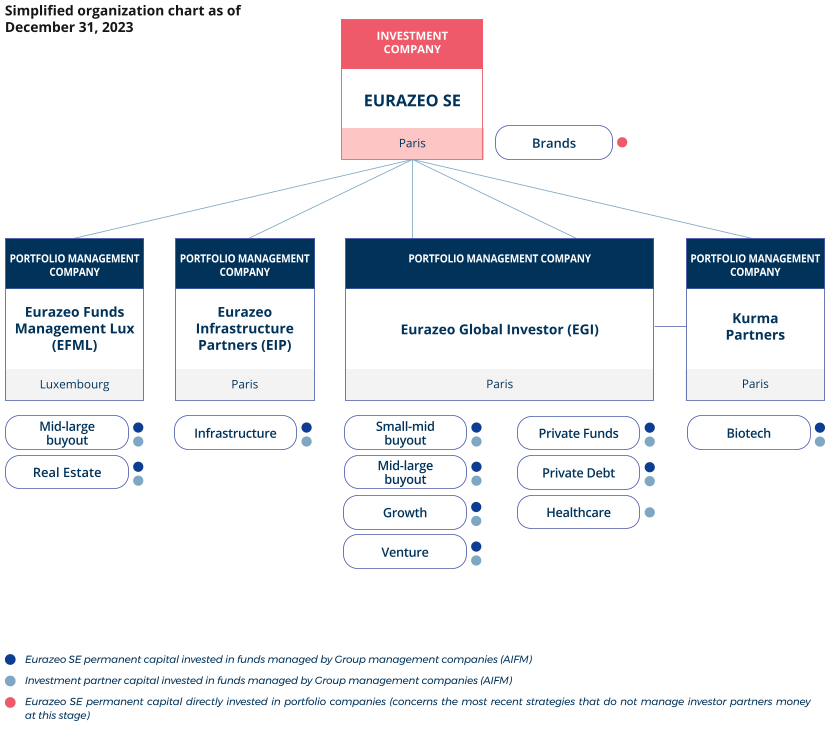

4.1.1An investment management strategy organized around an investment company and FOUR portfolio management companies

Eurazeo has three asset classes: Private Equity, Private Debt and Real Assets. - comprising a range of expertise/strategies enabling company financing across the entire investment spectrum. These strategies break down as follows:

- APrivate Equity: Buyout (Small-mid buyout and Mid-large buyout), Growth, Brands and Healthcare, Venture (including Biotech), Private Funds Group;

- APrivate debt (tailor-made financing for SMEs valued at between €25 million and €500 million);

- AReal Assets: Real Estate and Infrastructure.

Across all these strategies, the Eurazeo group seeks to deploy both its clients’ capital (third-party fund management) and the capital on its balance sheet (permanent capital of the Eurazeo SE investment company).

Some of the more recent strategies may be backed primarily by Eurazeo’s balance sheet until their performance becomes sufficiently attractive for fundraising with third-party investors. The more mature strategies are generally financed by both Eurazeo SE permanent capital and clients’ capital, with this capital invested in funds managed by one of the Group portfolio management companies. At the date of this Universal Registration Document, the Eurazeo group controls four management companies certified as an Alternative Investment Fund Manager (AIFM): Eurazeo Funds Management Lux (Luxembourg), Eurazeo Global Investor, Eurazeo Infrastructure Partners and Kurma Partners, based in Paris. Eurazeo Global Investor (EGI) was created by the merger, as of December 31, 2023, of the management companies, Eurazeo Mid Cap and Eurazeo Investment Manager. This merger provides clients with a simplified and clear structure carrying most of the product offering, and accelerates the harmonization of internal processes between the different strategies.

In simplified terms, the diagram below presents the allocation of the different strategies adopted by the Eurazeo SE investment company and/or the portfolio management companies as at 31 December 2023.

-

4.2Risk factors

A summary table of the main Eurazeo risk factors is presented below; it contains the risk factors deemed significant when making investment decisions, with regard to the effects they could have on the Company, particularly its business continuity, the successful conduct and performance of its activities (financial impacts, particularly on management fees, performance fees or the net value of Eurazeo’s portfolio) or its development (particularly reputation and human factors).

The risk factors are classified in a limited number of categories depending on their nature: (i) strategic and operational risks linked to activity, (ii) image and compliance risks, and (iii) financial risks. In each presented category, the risks are ranked based on their criticality (i.e. presented in decreasing order of importance).

The level of criticality is evaluated during a risk mapping exercise, based on a combination of the probability of occurrence and the estimated impact of each risk, and considering measures put in place to mitigate the risk. The risk criticality is assessed on a four-point scale (low, moderate, high, significant). Only risks with a “moderate”, “high” or “significant” criticality level are set out in this chapter. The risk presentation, ranking and description only provides a snapshot at a given moment. Depending, in particular, on changes in the economic environment and market conditions, exposure to a risk factor and the magnitude of related risks are likely to vary.

Information on financial risks is also presented pursuant to the French Commercial Code (Article L. 225-100). Other risks, not known or not considered material by Eurazeo at the date of this Universal Registration Document, could also impact its activities.

4.2.1Strategic and operational risks linked to activities

4.2.1.1Uncertainties relating to the macro-economic environment

Risk that a deterioration in the business climate (inflation, energy crisis, low growth/recession, reduced appeal of certain sectors, outcome of the war in Ukraine, etc.) (i) negatively affects the performance of the portfolio companies and/or (ii) alters the investment, transformation, value enhancement and divestment conditions for portfolio companies.

Generally speaking, an adverse change in the political and economic environment and a deterioration in the business climate can alter investment conditions. Unfavorable economic prospects are also liable to have an adverse impact on the future performance of certain portfolio companies, which for Eurazeo could be negatively reflected in its consolidated financial statements (performance fees, portfolio net value in the balance sheet) and/or the performance of its funds under management.

As regards the geographic spread of the current portfolio, portfolio companies operate mainly in Europe, making their performance particularly sensitive to economic growth in this region. Depending on their business model and sector, the activities of Eurazeo’s portfolio companies have differing levels of sensitivity to changes in the economic environment. With the maturity of the Private Equity industry, sector specialization has become crucial to the relevance and performance of investments. The Group has successfully positioned itself in segments with underlying growth trends: business services, financial services, tech, healthcare and energy transition. It is recalled that during the Covid-19 pandemic health crisis, the Eurazeo group demonstrated the excellent resistance of a large portion of its portfolio as well as its financial strength, attesting to the relevance of its diversification strategy. Overall, the portfolio companies confirmed their ability to adapt their strategic road map to a new difficult context.

In 2022, the global economy was marked by the resurgence of long-term widespread price increases (which led to stringent monetary policies and rising interest rates) and a major energy crisis (shortage and surge in prices of raw materials: gas, coal and oil). These phenomena were exacerbated by the war which broke out in February 2022 between Ukraine and Russia. Considering the very low exposure in Ukraine and Russia, the direct effects of the war (and the related sanctions) on the Eurazeo group portfolio were extremely limited, both in terms of its revenue and production facilities. In 2023, despite a complex and uncertain economic context, the robust performance delivered by portfolio companies on the balance sheet (11% revenue growth) reflects the relevance of Eurazeo’s sector choices (particularly healthcare, business services, digital technology and energy transition).

The succession of adverse economic factors in recent years (Covid-19 pandemic, war in Ukraine, rising inflation, energy crisis, etc.) has weakened global macro-economic stability and contributed to a slowdown in worldwide growth. With regard to the global economic outlook for 2024, many uncertainties remain on the date of this Universal Registration Document: the pace at which inflation will slow, energy prices, interest rate movements or even a potential worsening of the business climate.

Potential effects

- AChange in the ability to transform, monetize and divest our portfolio companies in line with the investment vision

- ADeterioration in the performance of portfolio companies that may be reflected in the value of the balance sheet portfolio and the performance of funds managed

- ALiquidity problems for some portfolio companies

Example risk mitigation measures

- APartial investment strategy in resilient and/or high-growth potential business models

- ADiversified business portfolio, which has proved resilient since the start of the health crisis

- ACautious debt ratio and/or level of covenants

4.2.1.2Ability to raise funds

Risk that Eurazeo is unable to achieve its objectives to raise funds to finance its investment programs.

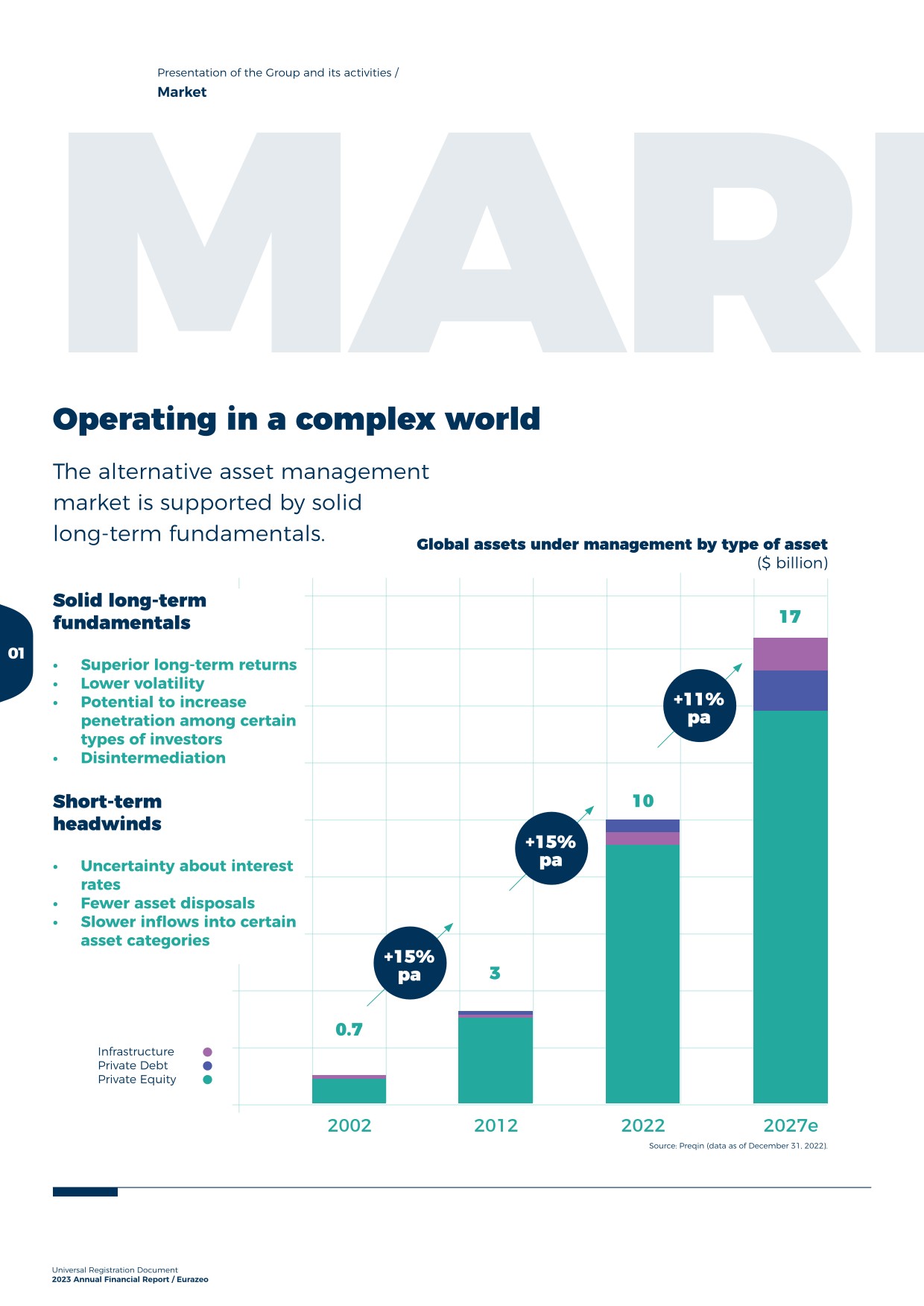

As of December 31, 2023, Eurazeo’s assets under management (AuM) stood at €35.0 billion, a 9% increase compared to December 31, 2022. In pursuing its ambition to become the European leader in private asset management, Eurazeo is exposed on the fundraising market to the behavior of international investors toward the asset classes in which it proposes to invest, in particular private equity. Whilst their appetite for this type of asset might be very high now, we cannot predict their future behavior. In a complex and uncertain market context, we note since 2022 a lengthening of the fundraising cycle in the private equity sector as a whole.

To mitigate the risk of its investors focusing on other asset classes, Eurazeo must be able to reinforce and expand its international investor network, and continue to deliver attractive performance to benefit clients. The Group is one of the very few in Europe that can offer its clients investment solutions in three high-yield asset classes - private equity, private debt and real assets and infrastructure - over the entire development cycle of companies - venture, growth, lower and upper midcap - and with expertise in all buoyant sectors. In addition, the support and expertise contributed by an experienced central team dedicated to marketing and fundraising (with professionals specialized by geographic area and/or product) represents a further competitive advantage.

Eurazeo finished 2023 up on 2022 with €3.5 billion raised, a real success in a market down 30% to 35%. This growth can be explained in particular by the success of the Eurazeo Private Debt VI program, which with €2.3 billion, including €2.1 billion from third parties, surpassed its initial objective, reflecting the confidence of our historic investors and several new international and French investors. The successful launch of Eurazeo Capital V fundraising marks an important step in Eurazeo’s transformation, illustrating the relevance of our positioning in the European mid-market sector. It also marks a major step in establishing an investor base for this historic Eurazeo activity. The Group has also made very good progress with its impact strategy, with the final closing of the Eurazeo Smart City II fund, above its initial target, followed in October 2023 by ESMI, Eurazeo’s first Article 9 fund, as well as strong fundraising by the transitional infrastructure fund (ETIF).

Potential effects

- AAdverse impacts on the level of management fees (stagnation or decline) and on Eurazeo net income

- AChange in Eurazeo’s ability to sustainably deploy its investment strategies

Example risk mitigation measures

- ATrack record (i.e. performance in previous vintages)

- AInvestor Relations: central team dedicated to marketing and fundraising, assisting the Group’s various strategies

- AStability of investment teams

- ABroad geographic coverage of international institutional investors

- AVariety of investor profiles: asset managers, sovereign funds, insurance companies, family offices

4.2.1.3Vetting of investment projects

Risk that analysis and due diligence work conducted for an investment project does not identify existing risks at the transaction date, which materialize later and ultimately result in a loss of investment value.

Investing in target companies may expose the Company to a number of risk factors, potentially leading over time to a loss of value for the relevant investment. These risks include:

- Athe overvaluation of the acquisition target, due for example to:

- •the insufficient capacity of the target company and its management to meet its business plan targets,

- •the undermining of the target company’s business model (i.e. technology break, adverse change in the regulatory environment, etc.) or any other unknown factor liable to lessen the consistency and reliability of management’s business plan (e.g. over-ambitious hypotheses),

- •the failure to identify or under-estimation of a significant liability or the incorrect valuation of certain assets;

- Athe lack of reliability of financial and accounting information on the target company: erroneous information may be provided when prospective investments are vetted, deliberately or otherwise;

- Alitigation and disputes liable to arise with sellers or third parties: these may relate to the insolvency of the sellers and their guarantors when applicable (making it difficult to implement guarantees), or to a change in management (which may threaten contracts with key suppliers or clients).

Eurazeo’s policies for managing these risks rely in large part on in-depth due diligence procedures and compliance with strict investment criteria. Prior to any acquisition, during the period when a prospective investment is vetted, Eurazeo performs a comprehensive analysis of the investment risks. Based on this analysis, in-depth due diligence procedures are conducted in strategic, operating, financial, legal and tax areas, generally by third parties. This comprehensive work notably encompasses social, environmental, compliance, digital and governance issues. On a case-by-case basis, risks identified can be covered by warranties negotiated with sellers or insurers. At the same time, in reviewing prospective investments, Eurazeo pays special attention to the following investment criteria: barriers to entry, profitability, recurrence of cash flows, growth potential and a shared investment vision with management. At the various stages of the vetting process, the risks associated with the target investment are assessed, documented and reviewed regularly during Investment Committee meetings.

Eurazeo has developed an approach to identifying investment opportunities well in advance of a sales process. This enables it to form an opinion about the vendor and the fundamentals of the target.

Potential effects

- ACapital loss on the investment

- AReduced investment program performance

- ATeams and management diverted from strategic priorities to tackle the risk

Example risk mitigation measures

- AIn-depth due diligence process

- ASeniority of Investment Committees

- AUnderstanding of sectors

- APotential targets approached well in advance of a sales process

- AInternal expertise: compliance, legal, ESG, digital, etc.

4.2.1.4Dependency on key personnel

Risk that the departure or prolonged absence of one or several key personnel (de facto or de jure) affects the successful conduct of Eurazeo’s activities and/or the activities of one of its portfolio companies

Eurazeo’s capacity to seize the right investment opportunities, to optimize the engineering of its acquisitions and to capitalize on the value-creation potential of its investments relies on its reputation, its networks, the skill and expertise of its Executive Board members and its Investment Officers. As such, the departure of one or several of these key people could have an adverse impact on Eurazeo’s business and organization; such a departure could alter not only the deal flow and investment projects under way at the time, but could also affect the management of Eurazeo’s teams and the Company’s relations with the management of its portfolio companies or with its institutional investors in the case of third party management activities. Moreover, with regard to third-party management, key people clauses are generally included in fund rules. If there are significant changes to the management team overseeing an investment program, activation of the key people clause can entitle institutional investors to review their fund liabilities (e.g. suspension of investments until a suitable successor is found for the departing key personnel).

Similarly, the departure, prolonged absence or loss of confidence of key people in the management team of one of our portfolio companies, for whatever reason, could have an impact on operations and the implementation of the investment’s strategy. The existence of a shared investment vision with management is central to Eurazeo’s investment criteria. During the development phase, Eurazeo’s teams and the management teams of each investment work to set out a clear vision of the goals to be achieved and actions to be taken in the short-, medium- and long-term. Portfolio company management also plays an important role in adapting to economic conditions.

To minimize this risk, Eurazeo makes the alignment of the interests of portfolio company shareholders, teams and management a key factor in promoting the continuity of management teams and value creation, notably through co-investment mechanisms and the progressive vesting of rights over instruments, such as performance shares. The Company also places emphasis on its close, regular and strong relations with management teams in its portfolio companies and the preparation of the succession of key people. Finally, close attention is paid to the drafting of key people clauses in the co-investment fund rules.

Potential effects

- AThe investments of one or several investment funds are suspended until the key personnel is/are replaced, pursuant to the key people clause

- ANegative effect on Eurazeo’s deal flow

- ANegative effect on Eurazeo’s image, affecting its ability to recruit talent and/or raise funds

- AUnderperforming portfolio company

Example risk mitigation measures

- AAlignment of interests through co-investment contracts

- ASuccession plans/Competitive job conditions

- ADrafting quality of key people clauses in fund rules

- ASharing the investment vision with portfolio company management

4.2.1.5Competition from other private equity firms

Risk that Eurazeo’s ability to deploy its private equity investment programs over the desired time horizon is altered due to increased competition from other industry firms and inflated valuations.

The Company operates in a competitive market due to the existence of a large number of private equity players. Strong competition for the most sought-after assets can lead to very high acquisition prices, particularly for assets in the most sought-after sectors. The excellent performance shown in recent years in the asset class representing private equity has attracted newcomers looking for returns which they could not achieve in other asset classes. This increased competition, associated with inflated valuations, is likely to reduce the field of attractive investment opportunities - it can also result in Eurazeo spending considerable time and expense on investment candidates where Eurazeo’s proposal is not selected or see the loss of some opportunities.

With its different private equity investment strategies, as well as investment teams working in Europe (France, UK, Germany, Italy, Spain) and North America, Eurazeo has a wide range of opportunities.

Also, by structuring its activity around different investment strategies focusing investment on growth companies with positive underlying economic trends (particularly in business services, specialty financial services, healthcare, environmental transition and new consumer trends), Eurazeo is able to identify and examine opportunities, and better understand vendors at a very early stage. This approach of identifying non-brokered deals offers a competitive edge in the sales process and can reduce exposure to competition inherent to brokered deals.

To effectively support its deal flow, Eurazeo also aims to reinforce its business network and continually seeks to further its understanding of strategic sectors. Teams rely on a digital deal flow monitoring process and a network of senior advisors with considerable experience in the industrial sector and an extensive business network.

Potential effects

- AIncrease in dead deal costs

- AAcquisition of overvalued assets in the event of an economic downturn

- AReduced performance of investment programs/loss of confidence by institutional investors

- ACompetition in human resources/headhunting

Example risk mitigation measures

- ARange of opportunities in more countries: Europe and North America

- AExtensive knowledge of structurally buoyant sectors

- ADiversification of investment strategies

- ADeal sourcing: dedicated team, digital deal flow

- ABusiness network: strategic partnerships, senior advisors

- ACompetitive job conditions for investment teams

4.2.1.6Technologies and data

Risk that IT system attacks and/or outages affect the confidentiality, availability and/or integrity of Eurazeo’s digital data and that of its partners, and notably prevent Eurazeo from ensuring business continuity, compliance with personal data and/or insider information regulations, or limiting the effect on its image/reputation with regard to partners and stakeholders.

In the conduct of its activities, Eurazeo uses IT infrastructures and applications to collect, process and produce data and.in particular, confidential and strategic data. Technical failures (equipment, software, network, etc.) or IT attacks (malware, intrusions, etc.) could impair the availability, integrity and confidentiality of data and have negative consequences for the Company’s business and reputation. The Company’s digital transformation, the development of cloud system data storage, or the increased use of key and/or business solutions in SaaS mode increase Eurazeo’s vulnerability to cyber-attacks. They also increase Eurazeo’s dependency on the reliability of third-party IT systems.

IT security is a priority for Eurazeo. For several years, a certain number of initiatives have aimed to implement suitable measures to protect its digital assets, as well as those of its controlled portfolio companies. The cyber risk prevention system is notably supported by an IT & Digital Committee, a Chief information Security Officer (CISO), an Information Systems Security Policy (ISSP), and the deployment of various technical measures reinforcing the security of access to digital resources. To check that this system is effective, IT security audits and intrusion tests are regularly performed and corrective action is taken where vulnerabilities are identified. Eurazeo has also taken out cyber and fraud insurance policies. In the current context of international tension, the risk of cyber-attacks likely to directly or indirectly impact European and North American companies is high. The Eurazeo group has therefore increased its level of vigilance.

Finally, in terms of continuity, Eurazeo’s disaster recovery plan is tested annually; it should enable the Company to continue its activities in the event of an IT incident and avoid data loss.

Potential effects

- ALeaks of confidential and/or strategic data relating to the activities of Eurazeo, its portfolio companies, its clients or other stakeholders

- AUse of insider information by a hacker

- AUse of sensitive and confidential data by a hacker for fraudulent purposes (see 4.2.1.7)

- AInfringement of personal data protection regulations

Example risk mitigation measures

- ACyber threat prevention system: Eurazeo Digital Security Committee, Cybersecurity Audits, ISSP, CISO, Cyber Roadmap, awareness campaigns for employees and portfolio companies, etc.

- ADisaster Recovery Plan, tested annually

- AInsurance policies: Cyber, Fraud

- AGovernance: cyber-security issues feature on the Audit Committee agenda at least twice a year

4.2.1.7Fraud

Risk that Eurazeo falls victim to fraud (usually embezzlement), particularly for payments made as part of closing and/or distribution operations.

During transaction closing operations or fund distributions, payment orders are given for sums sometimes totaling several hundred million euros, which are transferred to third-party bank accounts. These transactions expose Eurazeo to a greater risk of embezzlement by fraudsters. Criminal organizations have developed increasingly sophisticated fraud techniques which can include identity theft, strategic intelligence and cyber-attacks.

To mitigate this risk, Eurazeo has established a strict internal control framework for payment processes, and regularly raises employee awareness regarding fraud. Alongside this, the cyber risk prevention system developed by Eurazeo (see 4.2.1.6) aims to secure data linked to sensitive transactions and payments.

Finally, Eurazeo has also taken out cyber and fraud insurance policies.

Potential effects

- ALosses linked to embezzlement

- AImpact on reputation with regard to banks, insurers, clients and other stakeholders

Example risk mitigation measures

- ACyber risk prevention system

- AInternal controls governing payment

- AInsurance policies: Cyber, Fraud

- ARisk awareness/training

-

4.3Disputes

ANF Immobilier Chief Executive Officer and Real Estate Director

Proceedings are in progress following the dismissal and subsequent lay-off of ANF Immobilier’s Chief Executive Officer, Philippe Brion and its Real Estate Director, Caroline Dheilly, in April 2006. The employees dismissed in 2016 filed damage claims with the Paris Industrial Tribunal (Conseil des Prud’hommes) and the former Chief Executive Officer brought a commercial suit against ANF Immobilier before the Paris Commercial Court (since transferred to Evry), in his capacity as a former corporate officer.

Prior to the filing of these Industrial and Commercial court proceedings, ANF Immobilier lodged a complaint with an investigating magistrate (juge d’instruction) in Marseilles. It launched a civil suit pertaining to acts allegedly committed by the former supplier referred to below, as well as its two former Directors and other individuals.

On March 4, 2009, the judicial investigation office (chambre de l’instruction) of the Court of Appeal in Aix-en-Provence handed down a ruling confirming the validity of the indictment of ANF Immobilier’s former Chief Executive Officer and, hence, the existence of serious evidence that corroborated claims that he misused company assets to the detriment of ANF Immobilier. In March 2015, the Public Prosecutor requested the transfer of the case before the criminal court.

The Marseilles Criminal Court issued a judgment on July 4, 2017 dismissing the charges. The Court of Appeal in Aix en Provence confirmed the civil provisions of this judgment on June 27, 2018 and dismissed the claims of all parties. An appeal filed by ANF Immobilier was then rejected by the Court of Cassation.

At the end of 2018 and the beginning of 2019, Mr. Brion and Mrs. Dheilly reintroduced their claims before these courts. Their updated claims amounted to approximately €4.3 million. On November 18, 2019, the Paris Industrial Tribunal issued a joint order to Eurazeo and Icade to pay approximately €1.2 million to Mr. Brion. The Paris Court of Appeal reduced this amount to €840 thousand in a ruling on November 9, 2022. An appeal was filed with the Court of Cassation by Mr. Brion in June 2023.

In the Dheilly case, on October 29, 2021 the Paris Industrial Tribunal ordered Icade (as successor in interest to ANF Immobilier) to pay a total of €409,000 in respect of the various claims, considering the dismissal to be without fair cause. An appeal has been filed against this judgment.

In the Brion case, on December 16, 2021, the Evry Commercial Court ordered Icade (as successor in interest to ANF Immobilier) to pay approximately €325,000 for dismissal without good cause. An appeal has been filed against this judgment.

In addition, Mr. Brion filed a new claim before the Paris District Court against Icade (as successor in interest to ANF Immobilier), and former executives and managers of ANF Immobilier, seeking a joint order to pay damages and interest of around €30 million for malicious accusation. In a ruling of November 25, 2020, this court dismissed all of Mr. Brion’s claims and ordered him to pay €8,000 to Icade and Messrs. Keller and d’Amore. An appeal has been filed against this judgment.

-

Governance

This chapter reports on the preparation and organization of the work of the Company’s Supervisory Board and Executive Board. It also presents the corporate officer compensation policy.

The Company refers to the AFEP/MEDEF Code as revised in December 2022, with the exception of the recommendations set out in Section 5.3.1 “Framework of Supervisory Board” activities. Close attention is also paid to the activity report issued by the High Council for Corporate Governance (Haut Comité du Gouvernement d’Entreprise) and the AMF’s annual report on governance and executive compensation.

In accordance with the provisions of Article L. 225-68 of the French Commercial Code, this chapter includes the corporate governance report, appended to the Management Report. Pursuant to Articles L. 22-10-9 to L. 22-10-11 of the French Commercial Code and Article 8 of the AFEP/MEDEF Code of Corporate Governance, it reports in particular on:

- Achanges in the composition of the Supervisory Board and the Executive Board in 2023 and forthcoming changes in 2024;

- Athe activities of the Supervisory Board and the Executive Board;

- Athe Supervisory Board’s observations on the Executive Board’s report and on the financial statements for fiscal year 2023;

- Athe corporate officer compensation policy;

- Athe summary table of unexpired delegations of authority approved by the Shareholders’ Meeting;

- Aspecific procedures regarding the participation of shareholders at Shareholders’ Meetings;

- Afactors affecting a potential takeover or share exchange bid;

- Athe Supervisory Board diversity policy and application of the principle of balanced representation of men and women on the Board;

- Agender diversity policy within management bodies as well as the policy’s objectives and implementation methods and the results obtained during the past year.

The Management Report covers the conduct of the business, risks and corporate social responsibility. Information on internal control and risk management procedures implemented by Eurazeo is presented in the management report in Chapter 4 “Risk Factors” of the 2023 Universal Registration Document.

Since 2002, Eurazeo has opted for a dual governance structure comprising an Executive Board and a Supervisory Board. This choice was retained on the conversion of the Company to a European company (société européenne) at the Shareholders’ Meeting of May 11, 2017.

This dual governance structure with an Executive Board and a Supervisory Board reflects the best corporate governance standards. It ensures a balance of power between the Executive Board management functions and the Supervisory Board oversight functions.

The Executive Board is vested with the most extensive powers to act on behalf of the Company in all circumstances. It exercises these powers within the limits of the corporate purpose and subject to the powers expressly attributed by law and the Company’s Bylaws to Shareholders’ Meetings and the Supervisory Board. It determines the strategic direction of the Company and ensures its implementation, in the Company’s interest. Members of the Executive Board may, with the authorization of the Supervisory Board, allocate management tasks and permanent or temporary special assignments among themselves. This division of tasks may not cause the Executive Board to lose its status as the body responsible for the collective management of the Company. The Executive Board therefore has the necessary responsiveness and efficiency to perform its management duties.

The Supervisory Board permanently oversees the management activities of the Executive Board in accordance with the law and the Bylaws. At any time during the year, it conducts the verifications and reviews that it deems necessary. It may ask the Executive Board to communicate any documents that it considers necessary for the performance of its duties. The Supervisory Board’s diversity policy guarantees the quality of its management, its ability to anticipate, as well as its integrity and commitment to the performance of its oversight duties. This policy enables it to bring together leading individuals with a wide range of complementary experience.

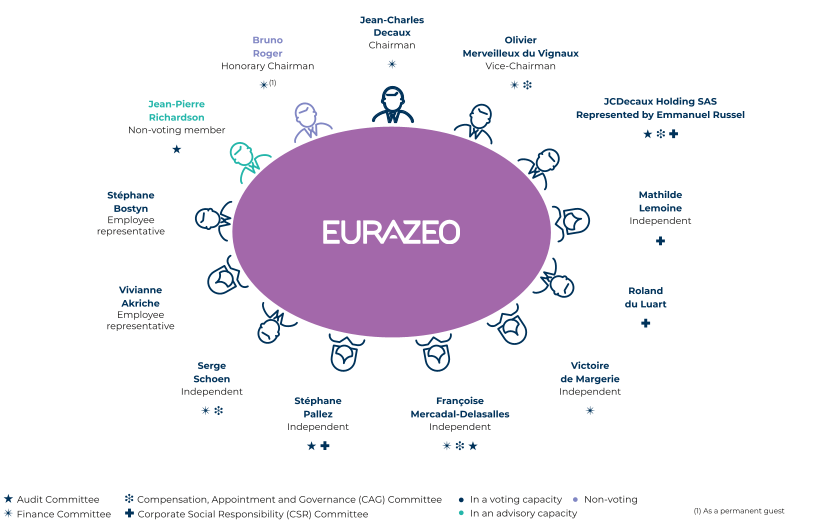

5.1The Supervisory Board and its activities

5.1.1Members of the Supervisory Board as of December 31, 2023

The composition of the Supervisory Board reflects a diversity of profiles, experience and complimentary skills adapted to the Company’s challenges.

Since April 28, 2022, Jean-Charles Decaux is the Chairman of the Supervisory Board. Olivier Merveilleux du Vignaux has been Vice-Chairman of the Supervisory Board since June 26, 2017.

As of December 31, 2023, the Supervisory Board has eleven members, including two members representing employees and a non-voting member. The Honorary Chairman, Bruno Roger, also attends meetings of the Supervisory Board with no voting rights.

The Supervisory Board has four female members, accounting for 44% of Supervisory Board members (excluding employee representatives). Five members are independent, representing 56% of this total. The Company therefore complies with prevailing regulations (See Section 5.1.2 “Supervisory Board Diversity Policy”).

The Supervisory Board members are invited to participate in the four specialized committees that assist the Supervisory Board in its decisions: an Audit Committee, a Finance Committee, a Compensation, Appointments and Governance (CAG) Committee and a Corporate Social Responsibility (CSR) Committee. Each Committee has between three and seven members, appointed in a personal capacity by the Supervisory Board, at the recommendation of the CAG Committee, according to their experience and preferences. The CAG Committee ensures that each Committee includes independent members in accordance with the provisions of the AFEP/MEDEF Code and no executive corporate officers, that is two-thirds independent members for the Audit Committee (see Article 17.1 of the AFEP/MEDEF Code) and a majority of votes held by independent members for the CAG Committee (see Article 18.1 of the AFEP/MEDEF Code).

The composition of the Supervisory Board and its Committees was reviewed by the CAG Committee during 2023. In the context of its procedures, the CAG Committee issued new recommendations in line with the Supervisory Board diversity policy on the following topics: renewal of the terms of office expiring in 2023 and 2024, the appointment of new Supervisory Board members at the Shareholders’ Meeting of May 7, 2024 and the composition and chair of certain Committees (See Section 5.1.2 “Supervisory Board Diversity Policy”).

-

5.2Offices and positions held by the Supervisory Board as of December 31, 2023

Jean-Charles DECAUX

Chairman of the Supervisory Board

Chairman of the Finance Committee

Age: 54 (07/08/1969)

Nationality: French

First appointment: June 26, 2017

End of term of office: 2024 Shareholders Meeting(1)

Business address:

JCDecaux SE

17, rue Soyer

92200 Neuilly-sur-Seine

- AJean-Charles Decaux is a French executive and Co-Chief Executive Officer with his brother, Jean-François Decaux, of JCDecaux group, which was created in 1964 and became, in 2011, the global number one in its sector, outdoor advertising. JCDecaux SE is listed on the Euronext Paris stock market.

- AJean-Charles joined the company in 1989. He was appointed Chief Executive Officer of JCDecaux Spain in 1991, which he developed. He then built, primarily through organic growth, all the subsidiaries in Southern Europe, South America, Asia and the Middle East.

- AFollowing the conversion in 2000 of JCDecaux to a limited liability company (société anonyme) with an Executive Board and a Supervisory Board, Jean-Charles and Jean-François Decaux performed an IPO in 2001 and actively participated in the consolidation of the sector, taking the JCDecaux group to global number one in February 2011. Jean-Charles Decaux was behind the JCDecaux group’s expansion into China and high-growth countries.

- AIn 2022, JCDecaux converted to a société européenne (European company), a new legal status more strongly representing the group’s European outlook to all its stakeholders.

- ASince 2017, he has come top several times of the Institutional Investor Awards “Small & Midcap Best CEOs” ranking in the Technologies, Media & Telecommunications category and the Extel “Top 100 best CEO - Pan-Europe” ranking.

- AJean-Charles Decaux is also a member of the Board of Directors of the French Association of Private Sector Companies (AFEP) and a director and donating member of AMREF (African Medical and Research Foundation) in France since 2005.

- AChairman of the Executive Board of JCDecaux SE* until May 16, 2023.

- ADirector of Metrobus SA, EXTIME MEDIA (previously Media Aéroports de Paris SAS), IGP Decaux Spa (Italy), JCDecaux Small Cells Limited (United Kingdom).

- AChairman of JCDecaux France SAS and JCDecaux Holding SAS.

- AMember of the Executive Committee of JCDecaux Bolloré Holding SAS.

- AChairman of the Board of Directors and Director of JCDecaux Espana S.L.U (Spain).

- ADirector of JCDecaux Holding SAS, Decaux Frères Investissements SAS, MediaVision et Jean Mineur SA and BDC SAS.

- AChief Executive Officer of Decaux Frères Investissements SAS and Apolline Immobilier SAS.

- AManager of SCI Troisjean, SCI Clos de la Chaîne and SCI du Mare.

- APermanent representative of Decaux Frères Investissements on the Supervisory Board of HLD SCA.

- AChairman of the Executive Board and Chief Executive Officer of JCDecaux SE* (N.B. Rotating chair).

- AChairman and Chief Executive Officer of JCDecaux Holding SAS (N.B. Rotating chair).

Olivier MERVEILLEUX DU VIGNAUX

Vice-Chairmanship of the Supervisory Board

Member of the Finance Committee

Member of the CAG Committee

Age: 67 (12/23/1956)

Nationality: French

First appointment: May 5, 2004

End of term of office: 2025 Shareholders’ Meeting

Business address:

MVM

Rue Ducale 27

B 1000 Brussels

Belgium

- AIn 1993, Olivier Merveilleux du Vignaux created MVM, a direct recruitment firm, of which he is the Manager.

- AHe was a Director of SAFAA until 1993, established and developed a recruitment firm with a partner from 1984 to 1992 and worked for Korn Ferry from 1980 to 1984, where he recruited senior executives through the direct recruitment method.

- AHe is a business school graduate.

JCDecaux Holding SAS

Represented by Emmanuel RUSSEL

Member of the Supervisory Board

Member of the Audit Committee

Member of the CSR Committee

Member of the CAG Committee

Age: 60 (09/05/1963)

Nationality: French

First appointment: June 26, 2017

End of term of office: 2025 Shareholders’ Meeting

Business address:

JCDecaux Holding SAS

17, rue Soyer

92200 Neuilly-sur-Seine

- AThroughout his career, Emmanuel Russel has held a range of executive management and financial management positions in several companies, and particularly the JCDecaux group, across many geographic areas.

- AHe is currently Deputy CEO of JCDecaux Holding, the investment holding company and controlling shareholder of the outdoor advertising group, JCDecaux. He is also Vice-Chairman of the Board of Directors of So.Co.Mix., the operating company for the Hôtel du Palais in Biarritz.

- ABetween 2013 and 2017, he was Chief Executive Officer of Compagnie Lebon, an investment holding company controlled by the Paluel-Marmont family and listed on the Euronext Growth market.

- ABetween 2000 and 2013, he held several positions in the JCDecaux group as Mergers & Acquisitions, Treasury and Finance Director and then, from 2006, Chief Executive Officer of the emerging Africa, Middle East, Central Asia and Eastern Europe area, leading its construction.

- AFrom 1990 to 2000, he held financial management positions in the Pernod Ricard group and particular Chief Financial Officer for Europe. He began his career with Arthur Andersen in 1987.

- AHe is a graduate of the Hautes Études Commerciales (HEC) business school and holds a post-graduate accounting and finance degree (DESCF).

- AChairman of JCDecaux Holding Immobilier SAS.

- AVice-Chairman and member of the Board of Directors of So.Co. Mix SA (Société Communale d’Économie Mixte pour l’Exploitation de l’Hôtel du Palais de Biarritz).

- AMember of the Supervisory Board of October SA.

- ADirector of B.D.C SAS.

- AMember of the Supervisory Committee of Compose Holdco SAS.

Mathilde LEMOINE

Independent member of the Supervisory Board

Member of the CSR Committee

Age: 54 (09/27/1969)

Nationality: French

First appointment: April 28, 2022

End of term of office: 2026 Shareholders’ Meeting

Business address:

Edmond de Rothschild

47, rue du Faubourg Saint-Honoré

75401 Paris Cedex 08

- AMathilde Lemoine has a PhD in economics and is an Economist. Expert in international issues and public policy assessment, she also has considerable operational experience. She has also developed governance expertise through directorships held over the past ten years and committees she has chaired.

- AMathilde Lemoine started her career as a lecturer and then as an economist and Secretary General of the French Economic Observatory (Observatoire Français des Conjonctures Economiques, OFCE). She was then a member of several ministerial offices where she contributed her knowledge of international macro-economic issues, participated in the preparation of WTO ministerial conferences and was a special advisor for tax affairs to the French Prime Minister.

- AShe was also rapporteur for the Expert Conference on Climate and Energy Contribution in 2009 and a member of the Attali Commission for the Liberation of Growth in 2010. She participated in a government mission reporting on the determining factors of French industry competitiveness, bringing her expertise on the competitiveness of the French economy. She has been a member of the Council of Economic Advisors (Conseil d’Analyse Economique) and the French National Economic Commission (Commission Économique de la Nation).